How to Buy Cryptocurrency Using a Credit Card – Best Methods in 2024

Discovering “How to Buy Cryptocurrency Using a Credit Card” is a crucial inquiry for investors navigating the vast world of Bitcoin. With its position as the largest coin by market capitalization, Bitcoin is actively traded on numerous global exchanges.

Initiating the purchase involves a straightforward process—inputting your credit card details, including the card number, CVV, and expiration date, on the exchange’s checkout page to acquire the desired Bitcoin value. This method, known for its speed and simplicity, brings significant advantages. However, before venturing into buying Bitcoin with credit cards, investors must carefully consider certain factors to ensure a correct and informed approach.

| Next Up In Investing |

| 7 Ways to Buy Cryptocurrency for Beginners |

| 16 Buy Cryptocurrency Without kyc Exchanges |

| How to Buy Cryptocurrency In India |

| How to Buy Bitcoin: A Step-by-Step Process |

Where to Buy Bitcoin with Credit Card – Top 5 Exchanges

Embarking on the journey to buy Bitcoin with a credit card in 2024? We’ve curated a quick overview of the best platforms to facilitate your seamless entry into the world of cryptocurrencies.

| Exchange | Key Features | Fees | Security | User-Friendliness |

| MEXC | User-friendly interface, innovative features | Competitive | High | Beginner-friendly |

| OKX | Low fees, diverse crypto selection, advanced options | Competitive | High | Diverse trader appeal |

| Binance | Largest trading volume, credit card support | Varied by region | High | Active trader focus |

| Coinbase | Established, user-friendly, instant purchases | 3.99%, higher for < $200 | High | Beginner-friendly |

| eToro | Fee-friendly, regulated, wide crypto support | Varies, 0.5% in non-USD | High | Cost-effective and secure |

Why Buy Bitcoin with a Credit Card?

In the realm of cryptocurrency, the method of payment holds significance, and opting to buy Bitcoin with a credit card offers a multitude of advantages.

- Swift Transactions: Credit cards ensure near-instant access to Bitcoin with transactions processed in seconds.

- Efficient KYC Process: Automated Know Your Customer (KYC) procedures make the initial setup quick, enabling future instant purchases.

- Enhanced Security: Reputable exchanges follow regulations and employ encryption for secure credit card transactions, minimizing fraud risks.

- Chargeback Safeguard: Credit card users have the safety net of a chargeback in case of fraudulent transactions, ensuring dispute resolution.

- Dollar-Cost Averaging Simplified: Credit cards streamline the dollar-cost averaging strategy with saved card details, making regular payments hassle-free.

- Effortless AML-Compliant Withdrawals: Cashing out is straightforward with withdrawals following anti-money laundering (AML) regulations, returning funds to the credit card within days.

- Fee Exploration: While some platforms may have higher fees, careful selection offers more economical alternatives for credit card transactions.

- Ideal for Mobile Transactions: The ‘Auto Fill’ feature on smartphones facilitates instant Bitcoin purchases on the go, aligning with the rapid pace of the crypto market.

In conclusion, choosing credit cards for Bitcoin transactions provides not only immediate access but also security and versatility, making it a reliable and efficient gateway in the complex landscape of cryptocurrency transactions.

How to Buy Bitcoin With a Credit Card

Investing in Bitcoin through a credit card is a relatively straightforward process, yet crucial factors need consideration. The type of credit card and the exchange’s compatibility are paramount elements in this endeavor.

Step 1: Explore Credit Card Options

Before diving into Bitcoin purchases, research the credit card and payment companies. Not every credit card supports Bitcoin transactions. Popular options include American Express, Mastercard, and Visa, each with its unique fee structure. Delve into these details to understand the charges imposed by the payment company.

Step 2: Research Compatible Exchanges

The choice of exchange plays a pivotal role. While some exchanges support credit card transactions for Bitcoin, others might not. Additionally, the process may not be instant due to validation procedures. For those not accepting credit cards, peer-to-peer (P2P) methods are used. Prominent exchanges like Binance, Kucoin, and Revolut facilitate Bitcoin purchases via credit cards. Thorough research ensures compatibility with your chosen credit card.

Step 3: Link Your Credit Card

Upon selecting a suitable exchange, verify your account by providing necessary personal information for KYC requirements. Subsequently, link your credit card to the exchange. Click on “add new card” and input your full name, card number, CVV, expiry date, and billing address.

Proceed by clicking “buy Bitcoin,” entering the desired amount, and opting for credit card payment. You’ll be directed to your bank’s one-time password (OTP) transaction page. Follow the instructions, and upon a successful transaction, witness your Bitcoin securely deposited into your wallet.

What You Need to Open an Exchange Account

Embarking on the journey to open an exchange account involves distinct requirements, varying between decentralized and centralized platforms. Here’s a breakdown of the essentials you need to consider:

For Decentralized Exchanges:

The process is straightforward for decentralized exchanges:

- Download Software or Browser Extension: Begin by downloading the necessary software or browser extension.

- Account Setup: Follow the setup procedures to create your account securely.

- Recovery Phase: Safeguard your account by storing the recovery phase provided.

For Centralized Exchanges:

Opening an account on centralized exchanges requires a bit more formality:

- KYC Verification: Prior to funding and trading, centralized exchanges mandate Know Your Customer (KYC) verification. Provide the following personal information:

- Full name

- Means of identification (e.g., passport)

- Proof of address (e.g., utility bills)

- Social Security number

- Additional details as per the specific exchange’s requirements.

- Minimum Deposits: Different exchanges have varying minimum deposit requirements. For instance:

- Coinbase necessitates a minimum deposit of $50.

- Binance, on the other hand, sets the bar at a minimum deposit of $10.

Understanding and fulfilling these requisites ensures a smooth onboarding process to your chosen exchange. Whether decentralized or centralized, each step plays a crucial role in establishing a secure and compliant trading environment. Stay informed and prepared as you navigate the realm of cryptocurrency exchanges.

Top Exchanges for Buying Bitcoin with Credit Card Reviewed

Dive into the realm of Bitcoin acquisition through credit cards by exploring the top exchanges meticulously reviewed for various factors, including fees, security, user-friendliness, and speed.

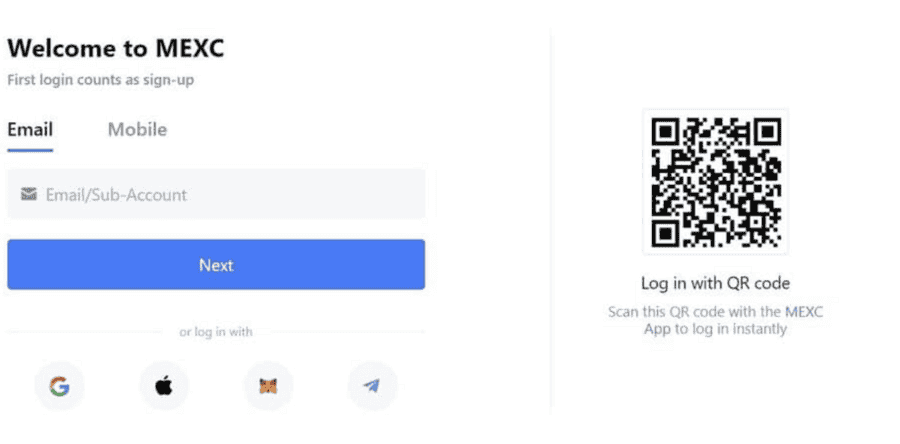

1. MEXC – A Holistic Choice for 2024

Established in 2018, MEXC stands out as the ultimate destination for credit card Bitcoin purchases. Serving over 10 million users across 170 countries, MEXC charges a minimal 2% fee for credit or debit card transactions. Boasting zero spot trading fees and supporting over 1,600 coins, MEXC offers diversity coupled with efficiency. The platform caters to both novice and experienced traders, providing advanced charting features, copy trading, and various payment options, including bank transfers and peer-to-peer transactions.

Pros:

- Zero Spot Trading Fees

- Over 1,600 Cryptocurrencies Supported

- High-Speed Transactions (1.4 million transactions per second)

- Copy Trading Feature

Cons:

- Not Available in the US (geographic limitation)

2. OKX – Prominent and Feature-Rich

OKX emerges as a prominent choice for credit card Bitcoin purchases, renowned for its low trading fees and extensive market support. With over 370 markets, including diverse cryptocurrencies, OKX charges a mere 0.1% for market orders, making it an attractive option for both short-term and long-term investors. The platform goes beyond trading, offering high-yield savings, staking, and a suite of advanced trading products for experienced traders.

Pros:

- Low Trading Fees (0.1% for market orders)

- Over 370 Supported Cryptos

- Passive Income through Savings and Staking

Cons:

- Not Available in the US and Canada

Visit OKX

3. Binance – Leading the Crypto Exchange Landscape

Binance, with its colossal trading volume, secures its position as the largest crypto exchange. With minimal trading commissions starting at 0.1%, Binance supports hundreds of trading markets, making it ideal for active traders. While credit card fees vary based on the currency, Binance offers a wide range of markets, Bitcoin savings accounts, and leveraged trading options.

Pros:

- Largest Crypto Exchange

- Trading Commissions from 0.1%

- Supports Hundreds of Crypto Markets

Cons:

- Credit Card Fees Vary by Currency

- Payment Gateways Unavailable for Some Currencies

Visit Binance

4. Coinbase – Regulated and User-Friendly

Established in 2012, Coinbase appeals to first-time Bitcoin investors with its simple and user-friendly platform. While fees for credit card transactions can be relatively higher (3.99%), Coinbase provides access to a wide range of cryptocurrencies, including security features such as cold storage and two-factor authentication.

Pros:

- Beginner-Friendly Platform

- Minimum Deposit of $2

- US-Based with Institutional-Grade Security

Cons:

- Higher Credit Card Fees (3.99%)

- Standard Trading Commission (1.49%)

Visit Coinbase

5. eToro – Competitive Fees and Simplicity

With over 30 million clients, eToro stands out for its competitive fees and simplicity. The automated KYC process and no credit card fees for USD payments make it an attractive choice. Supporting a vast array of cryptocurrencies, eToro provides a user-friendly platform with a minimum credit card deposit of just $10.

Pros:

- No Credit Card Fees on USD Payments

- Minimum Credit Card Deposit of $10

- Quick Account Opening and Payment Process

- Supports 90+ Cryptocurrencies

Cons:

- May not Suit Advanced Traders

- Does not Accept American Express

Visit eToro

Factors to Consider When Purchasing Bitcoin With a Credit Card

Embarking on a Bitcoin journey using a credit card demands strategic thinking. Here are critical factors to ponder:

1. Exchange Fees: Unveiling Hidden Costs

Swapping dollars for Bitcoin involves understanding exchange fees. Using a credit card often incurs additional charges. For instance, Coinmama tacks on a 5% fee for credit card transactions, adding $50 to a $1,000 Bitcoin purchase, excluding platform fees. A robust return on investment is essential to offset these costs.

2. Debt Dynamics: Tackling Volatility Wisely

Bitcoin’s inherent volatility amplifies investment risks. Using a credit card to delve into crypto investment introduces additional financial risks, with potential exorbitant interest payments on volatile assets.

3. Security Vigilance: Guarding Against Scams

Opting for a currency exchange lacking a robust security reputation poses risks. The possibility of personal information, including credit card details, being compromised underscores the importance of selecting a secure platform.

4. Cash Advance Penalties: Unraveling Complexities

Credit card issuers often treat crypto purchases as cash advances, triggering downsides such as:

- Higher interest rate: Expect a steeper annual percentage rate for cash advances compared to regular purchases.

- Foreign exchange fee: Utilizing an exchange outside the U.S. may incur a 3% foreign exchange fee.

- Cash advance fee: A one-time 3% to 5% fee on the withdrawn amount.

- No grace period: Unlike regular purchases, cash advances accrue interest from day one.

- Lower credit limit: Some cards impose a lower cash advance credit limit.

- Credit utilization impact: Substantial crypto purchases significantly impact available credit, affecting credit scores.

- No credit card rewards: Some issuers might not reward crypto purchases, treating them as cash equivalents.

How to Buy Bitcoin with Credit Card on MEXC – Tutorial

Ever wondered how to swiftly get your hands on Bitcoin using a credit card? Our step-by-step tutorial simplifies the process on MEXC, a regulated broker charging minimal fees (0% USD / 0.5% non-USD) for credit card deposits.

Step 1: Open Your MEXC Account

Visit MEXC’s site, hit ‘Sign Up,’ and breeze through standard registration. Verify your account with a mobile number via SMS.

Step 2: Deposit Funds with Your Credit Card

Once verified, deposit funds using Visa, MasterCard, or Maestro. Input details, specify the amount, and complete the payment.

Step 3: Locate and Buy Bitcoin

Navigate to MEXC, search ‘Bitcoin,’ and click ‘Trade.’ Complete the order box to seal the deal – your Bitcoin is securely stored.

Verification is Key

Buying Bitcoin with a credit card requires identity verification. Compliance with anti-money laundering laws means providing personal info, a government-issued ID, and proof of address. For substantial transactions, additional KYC measures may apply.

Enjoy a seamless Bitcoin purchase journey on MEXC, ensuring efficiency and security.

Conclusion – How to Buy Cryptocurrency Using a Credit Card

Before buying crypto with your credit card:

- Consider Alternatives: Direct deposits or debit cards might be more cost-effective.

- Watch for High Fees: Credit card transactions often come with hefty fees, impacting your returns.

- Debt Risks: The volatile crypto market combined with credit card usage can lead to significant debt.

- Talk to Issuers: If you still choose credit cards, discuss terms and consequences with your card issuer.

In short, be cautious—explore alternatives, understand fees, and mitigate risks when venturing into crypto with credit cards.