Looking to buy cryptocurrency without KYC or verification? In 2023, we’ve curated a list of the 18 best non-KYC crypto exchanges. As government regulations tighten, finding secure and private platforms is crucial. Our expert team presents the top 18 exchanges, balancing anonymity and security. Explore our curated guide for a seamless and private crypto trading experience in the evolving landscape of 2023.

The Top No KYC Crypto Exchanges Ranked

| Exchange | Cryptocurrencies | Custody | KYC | Location Restrictions | Key Features |

| MEXC | 1600+ | Custodial | Tiered | No US residents | One of the largest, 0% trade fees, Withdraw up to 30 BTC |

| CoinEx | 600+ | Custodial | None | No US residents | Spot and futures trading, Yield farming with idle crypto |

| dYdX | 35+ | Hybrid | None | No US or Canadian residents | – |

| Bybit | 400+ | Custodial | Tiered | No US residents | – |

| PrimeXBT | 5+ | Custodial | None | No US residents | Multi-asset trading platform, Leveraged trading, Copy trading |

| Bisq | 30+ | Non-custodial | None | None | – |

| Hodl hodl | 1 | Non-custodial | None | None | – |

| Uniswap | 900+ | Non-custodial | None | None | Decentralized exchange on Ethereum, Token and NFT swapping |

| PancakeSwap | 50+ | Non-custodial | None | None | Leading DEX on BNB Smart Chain, Token swaps, Yield farming, NFTs |

| SimpleSwap | 500+ | Non-custodial | None | No US residents | – |

| Changelly | 200+ | Non-custodial | None | No US residents | Oldest crypto exchange, Allows crypto coin swaps without an account |

| TradeOgre | 120+ | Custodial | None | None | – |

| Pionex | 330+ | Custodial | Tiered | None – products may be restricted | – |

| ProBit | 400+ | Custodial | Tiered | None | – |

| OpenPeer | 10+ | Non-custodial | None | No US residents | – |

What is KYC Verification?

KYC, or Know Your Customer, is a standard procedure in the financial world for verifying customer identities and assessing potential risks. Typically, it involves collecting personal data and documents such as names, addresses, and government IDs, and, in some cases, even a quick video or selfie.

Crypto exchanges adopt KYC to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. This verification process helps prevent illegal activities on their platforms and safeguards users from fraud, enhancing the overall security of transactions. It’s also a strategic move to maintain good relations with banks and payment processors.

However, some crypto investors shy away from KYC for various reasons:

- Privacy Concerns: Sharing personal information raises privacy concerns, especially given the potential risk of data breaches.

- Ease of Access: KYC procedures can be time-consuming, deterring those seeking a quick entry into trading.

- Global Accessibility: Disparities in access to required documentation and unsupported countries can limit users. No-KYC exchanges often offer more accessibility.

- Anti-Crypto Sentiment: KYC clashes with the crypto movement’s principles of anonymity, decentralization, and self-custody.

What are the best exchanges to buy cryptocurrency without kyc?

1. MEXC

MEXC, a global crypto exchange, distinguishes itself by offering a hassle-free platform without mandatory KYC procedures. With millions of users engaged in daily transactions, MEXC facilitates the buying, selling, and trading of over 1600 cryptocurrencies, boasting substantial daily trade volumes.

Key Features:

- Diverse Product Offerings: MEXC provides various options, from spot and P2P trading to futures trading, leveraged ETFs, and innovative savings products.

- Competitive Fee Structure: Users benefit from one of the lowest fee structures in the crypto exchange landscape, with significant discounts for MXC holders.

- Flexible KYC Framework: While KYC is available, it’s not mandatory for all users. The platform offers three account tiers, with unverified users enjoying a 5 BTC withdrawal limit within 24 hours.

Considerations:

- Geographical Limitations: As of late 2023, MEXC is not accessible for U.S. residents. The platform emphasizes adherence to terms and conditions, warning against attempting to bypass restrictions with a VPN.

In essence, MEXC provides a user-friendly and accessible platform for buying and trading cryptocurrencies, with a flexible approach to KYC. Users should be aware of geographical limitations to ensure a compliant trading experience. Explore the diverse opportunities MEXC offers while balancing convenience and compliance.

2. CoinEx

CoinEx, a global no KYC exchange, caters to users worldwide, spanning Europe, North America, and Australasia. Boasting a diverse array of investment options, the platform features over 600 cryptocurrencies for spot trading, margin trading, and futures trading.

Key Highlights:

- Versatile Investment Opportunities:

- CoinEx offers an extensive range of investment avenues, including spot and margin trading, futures trading, and enticing earn products.

- Fee Structure:

- With relatively low trading fees, CoinEx provides tiered discounts for CET token holders, offering reduced fees as low as 0.1%.

- Privacy Priority:

- Noteworthy for privacy-conscious traders, CoinEx does not enforce mandatory KYC verification, aligning withdrawal limits with users’ VIP tiers based on CET holdings.

- US Investor Advisory:

- U.S. investors should be aware that CoinEx, as of June 2023, has halted onboarding new clients from the United States, following regulatory developments.

In essence, CoinEx emerges as a global crypto haven, offering diverse investment opportunities with a focus on user privacy. While the platform is ideal for those valuing anonymity, U.S. investors should stay informed about access restrictions. Explore the world of crypto with CoinEx, where global accessibility meets privacy-centric trading.

3. dYdX

dYdX, a hybrid decentralized exchange, specializes in perpetual trading options for over 35 cryptocurrencies. While it caters to advanced investors, offering sophisticated opportunities often restricted in certain countries, it stands out for its user-friendly approach.

To get started, simply connect a non-custodial wallet, with support for popular options like MetaMask, Trust Wallet, Coinbase Wallet, and WalletConnect-compatible wallets.

Key Features:

- Non-Custodial Nature: No KYC is required on dYdX, making it hassle-free for users outside restricted locations to access the platform immediately.

Limitations:

- US and Canada Restrictions: Unfortunately, residents in the US and Canada are unable to utilize dYdX, limiting accessibility in these regions.

In summary, dYdX is a gateway to advanced crypto trading, offering a non-custodial environment. While it’s not available in the US and Canada, users outside these regions can seamlessly explore the platform’s advanced trading options without the need for KYC verification. Dive into the world of sophisticated crypto opportunities with dYdX.

4. Bybit

Bybit, a leading crypto exchange, ranks among the top 5 in daily trading volume, exceeding $700 million. Offering access to 400+ cryptocurrencies and supporting major fiat currencies, it provides diverse investment avenues, including spot and margin trading, leveraged tokens, and derivatives.

Key Highlights:

- Investment Diversity: Bybit caters to various preferences, from active trading to passive income through savings accounts, liquidity mining, and ETH 2.0 staking.

- KYC Levels: To unlock all features, users must undergo Know Your Customer (KYC) verification, with different levels available. Non-KYC users face restrictions on earn products and a daily withdrawal limit of 20,000 USDT.

- Regulatory Landscape: Bybit does not serve US residents due to regulatory constraints. Using a VPN to bypass this restriction may result in account suspension.

5. PrimeXBT

PrimeXBT stands out as a global crypto exchange offering access to traditional markets like Forex currencies, commodities CFDs, and stock indices. While its crypto selection includes key assets such as Bitcoin, Ethereum, Litecoin, XRP, and EOS, what sets PrimeXBT apart is its firm stance on user privacy—no mandatory Know Your Customer (KYC). However, the platform retains the right to conduct identity or source of funds verification using a Customer Due Diligence procedure if necessary.

6. HODL HODL

HODL HODL is a pioneering non-custodial Bitcoin trading solution, facilitating direct peer-to-peer transactions without holding user funds. Through innovative multi-signature escrow, the platform enhances security, minimizing theft risks and expediting the trading process.

Key Highlights:

- Non-Custodial Security: HODL HODL’s approach ensures user funds are not held on the platform, enhancing security and reducing theft risks.

- Simplified Compliance: By avoiding the complexities of holding user funds, HODL HODL eliminates mandatory Know Your Customer (KYC) requirements, prioritizing user privacy.

- Flexible Trading: With no withdrawal limits in its peer-to-peer environment, HODL HODL provides users with unrestricted trading capabilities.

7. Uniswap

Uniswap, the leading decentralized exchange, boasts a remarkable Total Value Locked (TVL) exceeding $4 billion. Investors can enjoy swift and low-slippage trading for Ethereum, ERC-20 tokens, and various native cryptocurrencies across different blockchains. The platform also offers earning opportunities through liquidity provision on the dex.

Key Highlights:

- Diverse Trading: Uniswap facilitates seamless trading for Ethereum, ERC-20 tokens, and native cryptocurrencies on various blockchains.

- Liquidity Provision: Investors can earn through liquidity provision, enhancing opportunities within the decentralized ecosystem.

- Decentralized Access: Uniswap requires only a non-custodial wallet with funds to get started. With no KYC requirements and a commitment to user privacy, the platform prioritizes a hassle-free trading experience.

8. Pancakeswap

PancakeSwap, the leading decentralized exchange for BNB Chain, simplifies the trading of BNB and BEP-20 tokens. Utilizing a non-custodial wallet like Trust Wallet is all that’s needed to start trading.

Key Features:

- Easy Access: PancakeSwap offers a hassle-free setup, requiring only a non-custodial wallet for user convenience.

- Diverse Opportunities: Beyond trading, users can explore various investment avenues on the dex, including liquidity provision, farming, staking, and a lottery.

9. Simpleswap

SimpleSwap stands out as an instant crypto exchange, providing access to over 900 crypto and fiat currencies for seamless trading. What sets SimpleSwap apart is its user-friendly approach—no account registration is required. Users can initiate trades by setting terms, entering relevant wallet addresses, and executing the transaction.

Key Features:

- Instant Exchange: SimpleSwap offers a quick and straightforward exchange process, allowing users to trade without the need for account registration.

- No Mandatory KYC: Unlike many platforms, SimpleSwap does not impose mandatory Know Your Customer (KYC) requirements, providing a hassle-free option for buying and selling crypto without divulging personal information.

- User-Friendly Interface: The platform boasts a straightforward interface, making it an appealing option for users seeking simplicity compared to some decentralized exchanges.

10. Changelly

Changelly, a non-custodial crypto exchange, empowers investors to buy, sell, and trade over 200 cryptocurrencies. Beyond traditional transactions, the platform offers additional features such as earn products, margin trading, and perpetual futures trading.

Key Features:

- Simplified Access: Utilizing Changelly requires nothing more than a non-custodial wallet, including popular options like Exodus, Ledger, or MyEtherWallet.

- Non-Custodial Advantage: As a non-custodial platform, Changelly doesn’t mandate Know Your Customer (KYC) processes by default. While KYC may be required for specific transactions or products, the platform generally respects user privacy.

- Transaction Vigilance: While Changelly doesn’t enforce standard KYC processes, it retains the right to request details for flagged or suspicious transactions, maintaining a vigilant approach to security.

- Limitations for US Investors: Unfortunately, Changelly does not extend its services to investors in the United States.

11. TradeOgre

Established in 2018, TradeOgre stands out as a centralized crypto exchange offering a diverse array of over 120 cryptocurrencies for trading.

Key Features:

- Privacy Focus: TradeOgre places a premium on user privacy, proudly omitting mandatory Know Your Customer (KYC) processes. This commitment to privacy aligns with the exchange’s strong emphasis on privacy coins, notably Monero (XMR).

- Inclusivity for US Residents: Unlike many exchanges, TradeOgre presents an appealing option for US residents. Notably, its terms of service do not explicitly restrict services for users in the United States, making it a potential choice for those seeking a privacy-centric platform.

12. Pionex

Pionex, a well-known crypto exchange established in 2019, has gained popularity for its focus on automated trading, driven by free crypto trading bots. The platform offers a diverse range of more than 330 cryptocurrencies, with the added feature of leveraged trading.

Key Features:

- Automated Trading: Pionex specializes in automated trading, providing users with access to free crypto trading bots for seamless and efficient trading experiences.

- KYC Levels: While Pionex does implement Know Your Customer (KYC) procedures, users can choose from different levels, including Unverified, Level 1, and Level 2. The Level 1 KYC process requires minimal personal information, such as country and name, enabling users to enjoy basic functionalities.

- US User Services: Pionex extends its services to users in the United States. However, certain features, such as leveraged grid bots, margin grid bots, and leveraged tokens, may be restricted for US users.

13. ProBit

ProBit, a centralized crypto exchange, stands out for its extensive offering of more than 400 cryptocurrencies, providing users with a comprehensive platform for buying, selling, and trading. The exchange goes beyond basic transactions, incorporating Initial Exchange Offerings (IEOs), staking, and various earn products.

Key Features:

- Diverse Cryptocurrency Portfolio: ProBit’s platform boasts a rich selection of over 400 cryptocurrencies, catering to the diverse needs of crypto enthusiasts.

- KYC Levels: ProBit implements a two-tier Know Your Customer (KYC) process. Level 1 involves email verification, granting users access to essential functionalities like depositing, trading, staking, and withdrawing up to $5,000. Level 2 requires identity verification, elevating withdrawal limits to $500,000 and unlocking additional features, including participation in IEOs.

- US User Considerations: While ProBit doesn’t explicitly restrict services for US residents, certain products may be limited or unavailable to users in the United States.

14. OpenPeer

OpenPeer, a decentralized peer-to-peer exchange on EVM networks like Ethereum, Binance Smart Chain, and Polygon, puts user control at the forefront. Trading directly from self-custody wallets like Metamask or Trust Wallet, OpenPeer ensures security by never holding user funds, relying on a smart contract-based escrow system.

Unique to OpenPeer is its optional KYC, allowing traders to decide whether to implement it through decentralized identity systems. Operating primarily in USDT, OpenPeer supports 100+ fiat currencies and diverse payment methods, with liquidity in some pairs evolving due to its newer status.

Privacy is paramount, with OpenPeer never requesting personal details, creating a secure trading haven. While global, OpenPeer is unavailable to US residents and certain sanctioned countries. Its self-custodial contracts reinforce a permissionless approach, providing users control and security.

15. Kraken

Founded in 2011, Kraken stands out as one of the largest and most favored cryptocurrency exchanges in the United States. While some customer information is required, Kraken allows users to start trading without providing sensitive details like their Social Security number or Proof of Residence.

This distinctive feature emphasizes Kraken’s commitment to user privacy and flexibility. With a user-friendly interface and robust security measures, Kraken remains a trusted platform for cryptocurrency enthusiasts in the U.S., offering a seamless and secure trading experience.

16. SushiSwap

In 2020, SushiSwap emerged as a hard fork of the Uniswap protocol, quickly evolving into a thriving ecosystem with over $700 million in Total Value Locked.

Aligned with the ethos of decentralized exchanges, SushiSwap prides itself on not requiring Know Your Customer (KYC) verification. This means users can engage in trading activities without the need to disclose personal information, ensuring a seamless and privacy-focused experience.

With its robust protocol and commitment to user privacy, SushiSwap remains a noteworthy platform for cryptocurrency enthusiasts, offering a KYC-free alternative for those who value anonymity in their trading endeavors. Explore the decentralized landscape of SushiSwap, where innovation and user privacy converge for a rewarding trading experience.

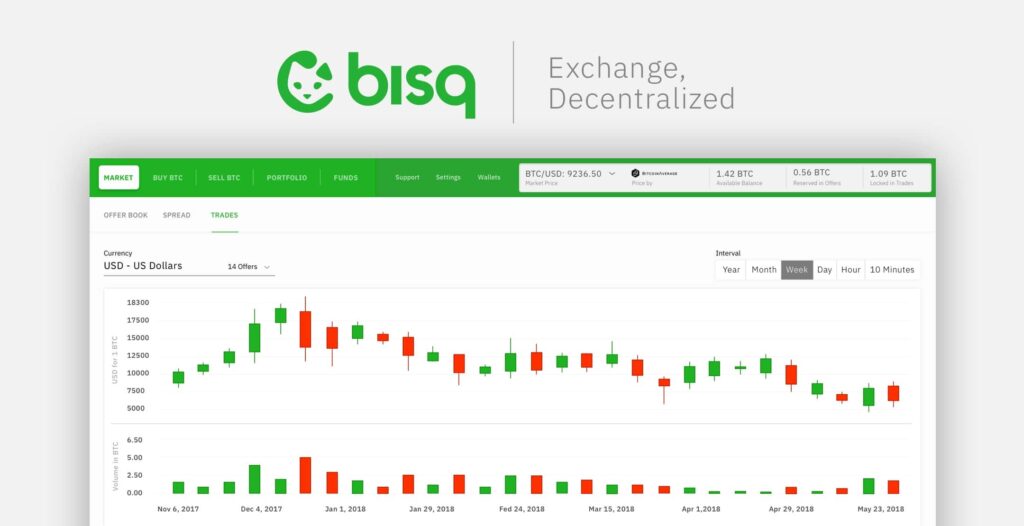

17. Bisq

Bisq, a decentralized Bitcoin exchange network, redefines peer-to-peer trading with its unique open-source software. In contrast to centralized exchanges, Bisq ensures non-custodial trades, never holding users’ funds. The platform prioritizes user privacy, avoiding the need for personal details during account setup, a practice prevalent in centralized exchanges.

Key Highlights:

- Privacy Focus: Bisq refrains from requesting personal details, prioritizing user confidentiality and security.

- Non-Custodial Trades: Users maintain full control over their funds, as Bisq facilitates trades without intermediaries holding assets.

- Flexible Trading: With minimal trade limits, Bisq provides users with freedom and flexibility in their trading activities.

Are NO KYC Exchanges Safe and Legal?

When it comes to the safety of no KYC exchanges, the reduced storage of users’ personal data minimizes the risk of breaches or unauthorized access, offering a comparatively safer environment than KYC exchanges. However, this absence of regulation exposes these platforms to other potential risks, such as money laundering or fraud, and users may find limited recourse in the absence of traditional financial system support.

The legal landscape for no KYC exchanges varies across jurisdictions. Many countries mandate KYC procedures for cryptocurrency exchanges, and non-compliance can result in legal consequences, including fines or shutdowns. In regions with less-defined regulatory frameworks, no KYC exchanges might operate in a legal gray area, with decentralized platforms like Uniswap or PancakeSwap generally accepted in most countries.

Regardless of the legal nuances, thorough research and a clear understanding of the risks are imperative. Staying informed about the regulatory environment in your country is crucial before engaging with no KYC exchanges.

Buying crypto without KYC proves challenging unless acquiring it directly from someone you know or with cash. Even no KYC exchanges often rely on third-party ID verification for fiat transactions, emphasizing the importance of understanding the intricacies of the process.

Do I have to report my transactions on no KYC crypto exchanges?

Absolutely. Even on no KYC crypto exchanges, tax obligations remain a critical aspect. Most tax authorities globally have issued explicit guidelines asserting that cryptocurrency transactions are taxable. Attempting to evade crypto taxes is considered tax evasion, a criminal offense carrying substantial penalties.

Tax offices worldwide are intensifying efforts to track investors potentially sidestepping crypto tax responsibilities. They are implementing dedicated operations to link wallet addresses with identities. If you’ve managed to evade crypto taxation so far, it’s only a matter of time before your tax office catches up with you. Staying informed and meeting your tax obligations is crucial in the evolving landscape of cryptocurrency regulation.

Will the government crack down on non-KYC exchanges?

There’s a possibility that the policies of the non-KYC exchanges mentioned below might undergo changes in the future. An illustrative example is Binance, which, in 2021, yielded to regulatory pressure and instituted mandatory KYC procedures for all new users after years of resistance.

In the United States, the crypto infrastructure bill mandates cryptocurrency brokers to furnish 1099 tax reporting information to the IRS. As the 2025 tax year approaches, it’s foreseeable that both centralized and decentralized exchanges will face requirements to collect KYC information from customers, aligning with the impending Form 1099-DA regulations. Staying informed about evolving regulatory landscapes is key for investors navigating the dynamic world of cryptocurrency.

Conclusion buy cryptocurrency without kyc

In summary, the top no-KYC cryptocurrency exchanges, including Rollbit, Changelly, Uniswap, SimpleSwap, and Curve Finance, appeal to users seeking private and secure digital transactions. While providing anonymity and diverse trading options, these platforms face regulatory challenges due to their non-compliance with standard KYC and AML laws. Striking a balance between user privacy and legal obligations remains a significant challenge for these exchanges in the evolving cryptocurrency regulatory landscape.