The Bitcoin white paper is a foundational document in the history of cryptocurrency. It was written by an anonymous individual or group under the pseudonym Satoshi Nakamoto and published on October 31, 2008. The paper titled Bitcoin: A Peer-to-Peer Electronic Cash System outlines the basic structure of the Bitcoin network and introduces the concept of blockchain technology.

The Bitcoin white paper is a relatively short document, but it is packed with important information. It is divided into nine sections, which cover the following topics:

Introduction

The introduction provides an overview of the Bitcoin system and its goals. It explains that Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for a central authority. This means that users can send and receive payments directly without the involvement of banks or other intermediaries.

The introduction also highlights some of the key features of Bitcoin, such as its limited supply (only 21 million bitcoins will ever exist) and its use of cryptography to secure transactions. It sets the stage for the rest of the paper by outlining the problems that Bitcoin aims to solve.

The Double-Spending Problem

The double-spending problem is a fundamental issue in digital currencies. It occurs when someone spends the same digital coin twice, essentially creating counterfeit money. In traditional financial systems, this problem is solved by having a central authority, such as a bank, verify and record all transactions. However, in a decentralized system like Bitcoin, there is no central authority to prevent double-spending.

The Bitcoin white paper proposes a solution to this problem using a distributed ledger called a blockchain. The blockchain is a public ledger that records all transactions in a chronological order. Each block in the chain contains a list of transactions, and once a block is added to the chain, it cannot be altered. This makes it virtually impossible for anyone to spend the same bitcoin twice.

The Bitcoin Network

The Bitcoin network is a peer-to-peer network, which means that there is no central authority that controls the network. Instead, the network is maintained by a network of computers that are called nodes. These nodes work together to verify transactions and add them to the blockchain.

Nodes also play a crucial role in securing the network. They use complex algorithms to solve mathematical puzzles and validate transactions. In return for their work, nodes are rewarded with newly created bitcoins. This process is known as mining and is essential to the functioning of the Bitcoin network.

The Bitcoin Protocol

The Bitcoin protocol is a set of rules that govern the operation of the Bitcoin network. It defines how transactions are created, verified, and broadcast to the network. The protocol also outlines the rules for adding new blocks to the blockchain and how miners are rewarded for their work.

Transactions

Transactions are at the heart of the Bitcoin protocol. They are the means by which users send and receive bitcoins. Each transaction contains information about the sender, the recipient, and the amount of bitcoin being transferred. Transactions are broadcast to the network and then verified by nodes before being added to the blockchain.

One of the key features of Bitcoin is that transactions are irreversible. Once a transaction is confirmed and added to the blockchain, it cannot be reversed or altered. This makes Bitcoin a secure and reliable form of digital currency.

Mining

Mining is the process by which new bitcoins are created and added to the network. As mentioned earlier, miners use powerful computers to solve complex mathematical puzzles and validate transactions. The first miner to solve the puzzle and add a new block to the blockchain is rewarded with a set amount of bitcoins.

Mining is an essential part of the Bitcoin protocol as it ensures the security and integrity of the network. Without miners, the network would be vulnerable to attacks and double-spending.

Consensus Mechanism

The Bitcoin protocol also includes a consensus mechanism to ensure that all nodes on the network agree on the state of the blockchain. This mechanism is known as Proof-of-Work (PoW) and is used to validate new blocks added to the chain.

In PoW, miners compete to solve a complex mathematical puzzle, and the first one to solve it gets to add a new block to the blockchain. This process ensures that all nodes on the network have a copy of the same blockchain and that no one can manipulate the data.

| Next Up In Investing |

| How Does Bitcoin Work |

| How to Read Bitcoin Charts |

| How Many Bitcoins for a Dollar? |

Cryptography

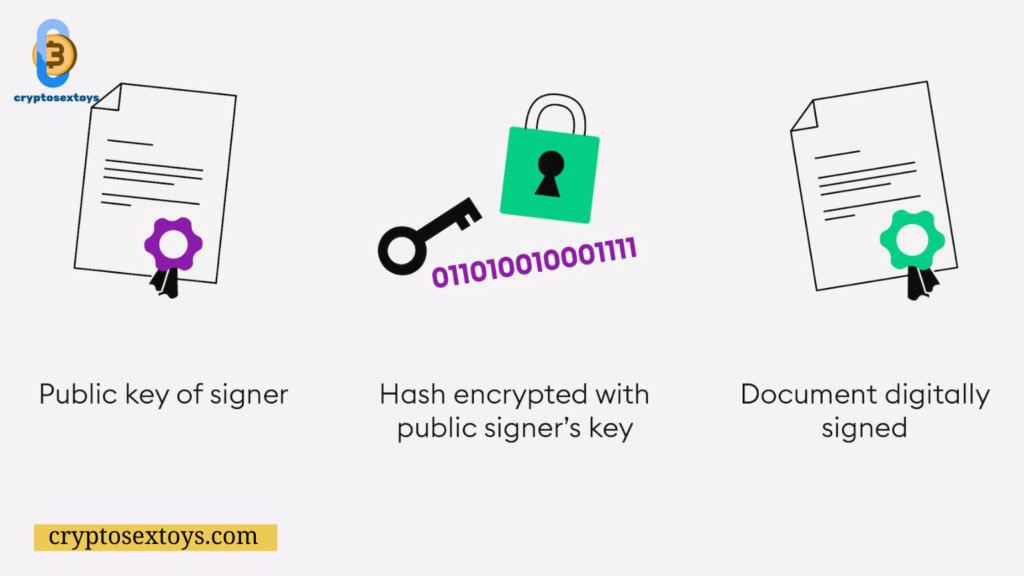

Cryptography plays a crucial role in securing the Bitcoin network. It is used to create digital signatures that verify the ownership of bitcoins and ensure that transactions are legitimate. Each user has a public key and a private key, which are used to encrypt and decrypt messages.

When a user sends a transaction, they use their private key to create a digital signature, which is then verified by the recipient using the sender’s public key. This process ensures that only the owner of the bitcoins can spend them and prevents anyone from tampering with the transaction.

Hash Functions

Hash functions are an essential part of the cryptographic system used in Bitcoin. They are mathematical algorithms that take in any input and produce a fixed-length output. In the case of Bitcoin, the input is a transaction, and the output is a unique code called a hash.

Hash functions are used to create digital signatures, which are then used to verify the authenticity of transactions. They also play a crucial role in mining, as miners use them to solve the mathematical puzzles required to add new blocks to the blockchain.

Public Key Cryptography

Public key cryptography is a method of encrypting and decrypting messages using a pair of keys – a public key and a private key. As mentioned earlier, each user has a public key and a private key, which are used to create digital signatures for transactions.

The public key is available to everyone, while the private key is kept secret by the user. This system ensures that only the owner of the bitcoins can spend them and provides a secure way to transfer ownership without the need for a central authority.

Advantages of the Bitcoin White Paper

The Bitcoin white paper has had a significant impact on the world of finance and technology. It introduced the concept of blockchain technology, which has since been adopted by numerous industries. Here are some of the key advantages of the Bitcoin white paper:

- Decentralization: The Bitcoin network is decentralized, meaning there is no central authority controlling it. This makes it resistant to censorship and government interference.

- Security: The use of cryptography in the Bitcoin protocol ensures that transactions are secure and tamper-proof.

- Transparency: The public nature of the blockchain allows anyone to view all transactions, promoting transparency and accountability.

- Lower transaction fees: Since there is no need for intermediaries like banks, transaction fees in the Bitcoin network are significantly lower compared to traditional financial systems.

- Global accessibility: Bitcoin is a global currency, and anyone with an internet connection can send and receive payments, regardless of their location.

Criticisms of the Bitcoin White Paper

While the Bitcoin white paper has many advantages, it has also faced its fair share of criticisms. Some of the main criticisms include:

- Volatility: The value of bitcoin is highly volatile, making it a risky investment.

- Energy consumption: Mining requires a significant amount of energy, leading to concerns about the environmental impact of Bitcoin.

- Scalability: The Bitcoin network can only process a limited number of transactions per second, making it challenging to scale for mass adoption.

- Lack of regulation: The decentralized nature of Bitcoin means that there is no central authority regulating it, leading to concerns about illegal activities such as money laundering.

Conclusion

In conclusion, the Bitcoin white paper is a groundbreaking document that introduced the world to the concept of cryptocurrency and blockchain technology. It outlines the basic structure of the Bitcoin network and proposes solutions to some of the fundamental problems in digital currencies.

The white paper has had a significant impact on the world of finance and technology, and its influence continues to grow as more industries adopt blockchain technology. While it has faced criticisms, the potential of Bitcoin and other cryptocurrencies cannot be ignored. The Bitcoin white paper will undoubtedly go down in history as one of the most influential documents of our time.