In the world of cryptocurrency, Bitcoin mining plays a crucial role in maintaining the security and functionality of the Bitcoin network. But what exactly is a Bitcoin miner, and how does Bitcoin mining work? Here, we will provide a foundational understanding of this essential process in the world of cryptocurrency.

Key Takeaways:

- A Bitcoin miner is a node in the Bitcoin network that validates transactions and creates new blocks in the blockchain.

- Bitcoin mining involves solving complex mathematical equations using specialized hardware and software.

- Mining rewards incentivize miners to continue validating transactions and securing the network.

- Mining has a significant environmental impact due to high energy consumption, leading to ongoing discussions around its sustainability.

- Potential risks and challenges in mining include centralization, 51% attacks, and the high cost of hardware and electricity.

Understanding Cryptocurrency Mining

In the world of cryptocurrency, mining is the process of verifying transactions and adding them to the blockchain. This process requires the use of computational power to solve complex mathematical equations, which in turn validates the authenticity of the transaction.

The process of cryptocurrency mining is similar to traditional mining in that it involves the extraction of valuable resources. However, unlike traditional mining, cryptocurrency mining does not involve the physical extraction of resources from the earth. Instead, it involves the extraction of digital assets from the blockchain.

The mining process is essential to the functioning of the cryptocurrency network. Without mining, transactions cannot be validated, and the network cannot operate. Miners are rewarded with newly created digital assets, creating an incentive for individuals or organizations to participate in the mining process.

The Role of Cryptocurrency Mining in Bitcoin Mining

Bitcoin mining is a specific type of cryptocurrency mining that focuses on the Bitcoin network. While the mining process for Bitcoin is similar to other cryptocurrencies, it requires specialized hardware to handle the complex calculations involved.

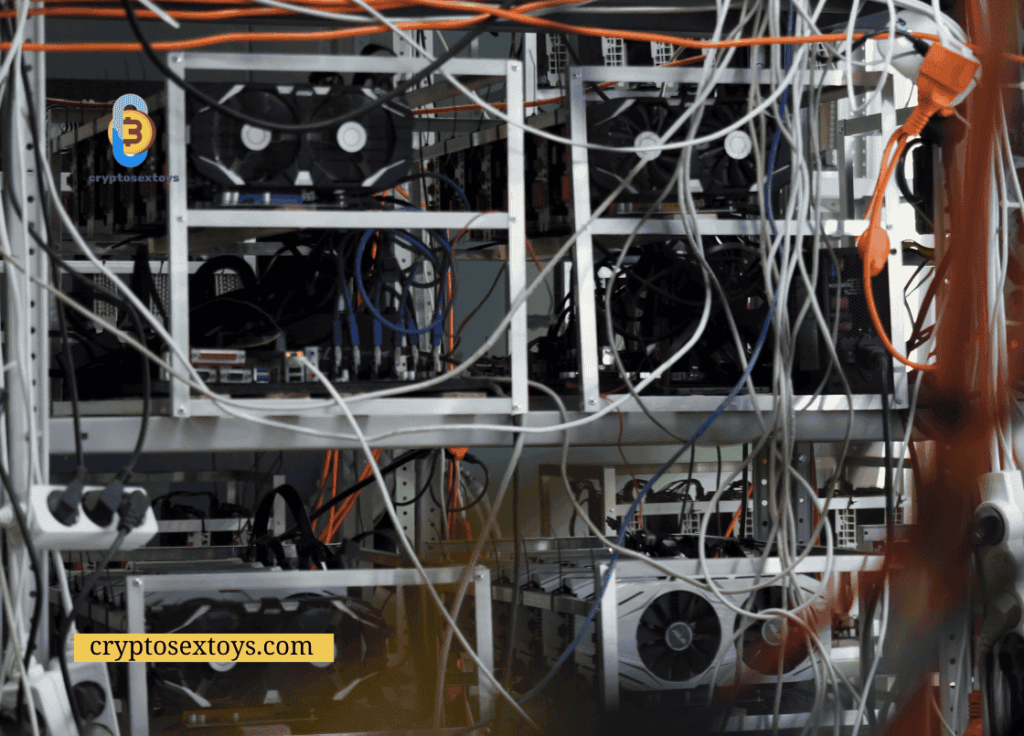

The computational power required for Bitcoin mining is immense. To be successful, miners need to have significant computing power to process large amounts of data accurately. This requirement has led to the development of specialized mining hardware, such as ASICs, that are designed specifically for Bitcoin mining.

The Basics of Bitcoin Mining

Bitcoin mining is the process of creating new bitcoins by solving complex mathematical equations. This process is crucial to the functionality and security of the Bitcoin network. In this section, we will discuss the technical aspects of Bitcoin mining, including the hardware and software required, as well as the steps involved in the mining process.

How to Mine Bitcoin

To mine Bitcoin, you will need specialized hardware and software. While it is technically possible to mine Bitcoin with a regular computer, it is not profitable due to the computational power required. Bitcoin mining hardware includes ASICs (application-specific integrated circuits), which are designed specifically for the mining process. ASICs are more efficient than traditional computer processors and can perform much faster computations.

Once you have obtained the appropriate mining hardware, the next step is to install mining software. There are various mining software options available, each with its own unique features and interface. Some popular mining software includes CGMiner, BFGMiner, and EasyMiner.

After installing the mining software, you will need to join a mining pool or set up a solo mining operation. Mining pools allow multiple miners to work together to solve blocks and receive mining rewards. When mining in a pool, miners combine their computational power, increasing their chances of solving a block and receiving a reward.

The Steps of Bitcoin Mining

Bitcoin mining involves several steps, including:

- Verification of transactions: Miners verify transactions by solving mathematical equations to confirm that they are legitimate.

- Collection of transaction fees: Miners earn transaction fees for verifying transactions.

- Solving the block: Miners compete to solve a complex mathematical equation to add a new block to the blockchain.

- Validation of block: Once a block is solved, it must be validated by other nodes on the network to ensure it is accurate.

- Mining reward: Miners receive a reward in the form of new bitcoins for successfully solving a block.

Overall, the Bitcoin mining process is complex and requires significant computational power and resources. However, by participating in the mining process, miners play a critical role in maintaining the integrity and security of the Bitcoin network.

The Role of Miners in the Bitcoin Network

Bitcoin mining is an essential process that keeps the Bitcoin network secure and functional. But how does crypto mining work, and how is Bitcoin mined? Let’s take a closer look at the role of miners in the cryptocurrency ecosystem.

Cryptocurrency mining involves validating transactions and adding them to the blockchain, a public ledger of all Bitcoin transactions. Miners compete to solve complex math problems using high-end computers, and the first miner to solve the problem and validate the transaction receives a reward in the form of newly minted Bitcoins. This process is known as proof-of-work and ensures that the network remains secure against fraudulent transactions.

Crypto miners play a vital role in maintaining the integrity of the blockchain and securing the Bitcoin network against potential attacks. By validating transactions, miners ensure that no double-spending occurs, which would undermine the entire blockchain.

Moreover, miners maintain the decentralization of the Bitcoin network by preventing any single entity from controlling more than 50% of the network’s computational power. If a single entity controls the majority of the computational power, it could potentially manipulate the blockchain and compromise the entire network. Crypto miners help to keep the network decentralized and secure against attacks.

Mining Rewards

Crypto miners are incentivized to maintain the integrity of the network through the prospect of mining rewards. Every time a miner validates a transaction and solves a block, they receive a reward in the form of newly minted Bitcoins. This reward serves as both an incentive for miners to participate in the process and as a means of distributing new Bitcoins into circulation.

However, the number of Bitcoins awarded for mining a block is halved every four years, a process known as halving. This is to maintain the limited supply of Bitcoins and prevent inflation. The current mining reward is 6.25 Bitcoins per block, and the next halving is anticipated to occur in 2024.

In addition to mining rewards, miners may also earn transaction fees for including transactions in their validated blocks. Transaction fees serve as a way to prioritize transactions and incentivize miners to include them in their blocks. Miners prioritize transactions with the highest fees, as they stand to earn more Bitcoin for including them in their validated blocks.

Ultimately, the rewards associated with Bitcoin mining serve as a means of incentivizing miners to maintain the security and functionality of the network. By participating in the mining process, miners help to keep the blockchain secure against potential attacks and ensure the continued success of the Bitcoin network.

| Next Up In Investing |

| How Does Bitcoin Work |

| How Many Bitcoins for a Dollar? |

| How to Read Bitcoin Charts |

The Economics of Bitcoin Mining

Bitcoin mining is not only a process of validating transactions and maintaining the integrity of the blockchain, but it is also an economic activity that can generate revenue for miners. In this section, we will explore the financial incentives and costs associated with Bitcoin mining.

Mining Rewards

Bitcoin miners are rewarded for their efforts with newly generated Bitcoins. The mining reward is halved every 210,000 blocks, which occurs approximately every four years. As of May 2021, the current block reward is 6.25 Bitcoins, which amounts to approximately $230,000.

Aside from the block reward, miners can also earn transaction fees from the transactions they validate and add to the blockchain. These fees can vary depending on network congestion, with higher fees being paid for faster confirmations.

Mining Costs

While mining can be a profitable activity, it also incurs significant costs. One major expense is electricity, as mining requires significant computational power and therefore consumes a lot of energy. In some cases, the electricity bill can be higher than the mining revenue earned.

Another expense is hardware, with specialized equipment such as ASIC miners being required for efficient mining. These machines can cost thousands of dollars and quickly become obsolete as newer models are released.

The Bitcoin Generator Myth

There is a common misconception that Bitcoin mining is a “Bitcoin generator” that can create unlimited amounts of Bitcoin. However, the total supply of Bitcoin is capped at 21 million, with approximately 18.7 million already in circulation as of May 2021. Once all 21 million Bitcoins are mined, no more will be generated.

How to Make Bitcoin through Mining?

Mining Bitcoin can be a profitable activity but requires significant investment in hardware and electricity. It is not advisable for individual miners to attempt mining without joining a mining pool, where hash power is combined to increase the chances of validating blocks and earning rewards.

Coin Mining Alternatives

For those who want to participate in cryptocurrency mining without the significant costs of mining Bitcoin, there are alternative cryptocurrencies that are more accessible and less competitive. These include Litecoin, Ethereum, and Monero, among others.

Legality of Bitcoin Mining

As Bitcoin mining becomes increasingly popular, many have raised questions about its legality. The answer to this question largely depends on the jurisdiction in which you reside.

In the United States, for example, Bitcoin mining is legal, but it is subject to taxes. According to the Internal Revenue Service (IRS), mining Bitcoin is considered a taxable activity, and miners must report their earnings as income.

However, in some countries, Bitcoin mining is not legal, and miners may face legal consequences if caught. In Algeria, for instance, Bitcoin mining is strictly prohibited, and those caught doing so may face fines or even imprisonment.

It’s essential to research the laws and regulations surrounding Bitcoin mining in your area before starting a mining operation. This can help you avoid any potential legal issues down the line.

Recent Developments in Bitcoin Mining Regulation

Regulations surrounding Bitcoin mining are constantly evolving, and it’s crucial to stay up to date to ensure compliance. In 2021, China cracked down on Bitcoin mining, and many miners were forced to shut down their operations.

The reasons behind this crackdown were primarily environmental, as China aimed to reduce its carbon footprint. As a result, many miners are now looking to move their operations to other countries with more lenient regulations and cheaper energy costs.

It’s essential to keep an eye on any regulatory developments in your area and be prepared to adapt your mining operation accordingly.

Advancements in Mining Technology

Bitcoin mining has been continuously evolving since its inception. The process started with CPU mining, which was soon replaced by GPU mining due to the latter’s enhanced computational capabilities. Later, Application Specific Integrated Circuits (ASICs) emerged as the preferred hardware for mining due to their higher efficiency and lower power consumption.

Today, mining technology continues to advance, with dedicated mining rigs becoming increasingly common. These rigs feature multiple ASIC miners working in tandem, further increasing the computational power for mining. Additionally, advancements in cooling technology have led to the development of liquid-cooled ASIC miners, reducing the risk of hardware failure and increasing overall performance.

The emergence of cloud mining services has also contributed to the evolution of mining technology. These services allow users to rent mining hardware remotely, eliminating the need for users to purchase and maintain their equipment. Furthermore, cloud mining services typically offer access to specialized hardware that may be difficult for the average user to acquire and operate.

As mining technology continues to evolve, the barrier to entry for new miners may become higher. With the increasing costs of specialized hardware and rising energy consumption, mining may become more challenging for individuals. However, advancements in mining technology also offer potential benefits, including increased security and efficiency for the Bitcoin network.

Environmental Impact of Bitcoin Mining

The digital money that’s mined through the Bitcoin network has significant environmental implications. Crypto mining requires a vast amount of computational power, which consumes a massive amount of electricity. As more miners join the network, the energy consumption required for mining operations increases correspondingly. This has led to concerns about the carbon footprint of the Bitcoin network and its contribution to climate change.

According to a study conducted by the University of Cambridge, the annual electricity consumption of the Bitcoin network is estimated to be around 121 TWh (terawatt-hours). To put this figure into context, this is more than the annual electricity consumption of countries like Argentina and Norway.

Furthermore, the majority of Bitcoin mining operations take place in regions where energy is generated through fossil fuels such as coal. As a result, Bitcoin mining has become a significant contributor to greenhouse gas emissions. Some estimates suggest that the carbon footprint of each Bitcoin transaction is equivalent to that of 680,000 Visa transactions.

Despite these concerns, there have been efforts to address the environmental impact of crypto mining. Some miners have started using renewable energy sources such as hydropower, solar, and wind to power their mining operations. Others have implemented energy-efficient technologies to reduce their energy consumption.

The Carbon Footprint of Cryptocurrency Mining

A recent report by CoinShares estimates that 74.1% of Bitcoin mining is powered by renewable energy sources. While this is a promising trend, it’s worth noting that the remaining 25.9% still relies on fossil fuels.

| Country | Annual Electricity Consumption (TWh) | Bitcoin’s Share of Electricity Consumption | Carbon Footprint (MtCO2) |

| China | 6,540 | 65% | 130.4 |

| United States | 4,010 | 7.2% | 31.9 |

| Russia | 1,068 | 6.9% | 12.3 |

As seen in the table above, China is responsible for the majority of Bitcoin’s electricity consumption and carbon emissions. However, it’s worth noting that China has also been making significant strides in renewable energy, with more than 40% of its electricity generated from renewable sources as of 2020.

In conclusion, while Bitcoin mining has significant environmental implications, efforts are being made to reduce its carbon footprint. As the world becomes increasingly aware of the impact of climate change, it’s likely that we will see more miners transitioning towards renewable energy sources in the future.

Potential Risks and Challenges in Mining

Bitcoin mining can be a lucrative and rewarding experience, but it also comes with its own set of challenges and risks. It is important to be aware of these possible drawbacks before venturing into the mining world.

Centralization

One of the major concerns in Bitcoin mining is the issue of centralization. As larger mining farms and pools begin to dominate the network, the decentralization that originally made Bitcoin so revolutionary could be lost. This centralization could lead to a concentration of power and a potential for network manipulation or attack.

51% Attacks

Another potential risk in mining is the possibility of a 51% attack. If a single entity controls over 51% of the network’s computing power, they could potentially manipulate or even reverse transactions on the blockchain. This threat could have severe implications for the security and trustworthiness of the entire Bitcoin network.

Hardware Obsolescence

As mining technology continues to advance rapidly, older mining hardware can quickly become obsolete. This can lead to a significant financial loss for miners who have invested in expensive equipment that is no longer profitable to use. It is important to stay up to date with the latest mining hardware and technology to remain competitive in the mining world.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin and cryptocurrency mining is constantly evolving. Miners may face legal challenges and uncertainty in various jurisdictions, which could impact the profitability and viability of their operations.

Conclusion

While Bitcoin mining can be a profitable and exciting venture, it is important to be aware of the potential pitfalls and risks. It is crucial to stay informed about the latest developments in mining technology and regulatory changes to ensure a successful and sustainable mining operation. By being aware of these risks, miners can make informed decisions and navigate the mining world with confidence.

Conclusion

In conclusion, Bitcoin mining is a crucial process in the cryptocurrency ecosystem. We have explored the technical aspects of Bitcoin mining, including the specialized hardware and software involved. We have also discussed the important role that miners play in validating transactions, maintaining the integrity of the blockchain, and securing the network against potential attacks.

Furthermore, we have examined the economic aspects of Bitcoin mining, including the financial incentives for miners and the costs associated with mining operations. We have also explored the legal considerations surrounding Bitcoin mining, including the regulatory landscape in various countries.

Beyond that, we have looked at the advancements and innovations in mining technology, as well as the environmental impact and potential risks and challenges associated with mining.

Understanding the Importance of Bitcoin Miners

Bitcoin miners are the backbone of the Bitcoin network. They provide the necessary computational power to validate transactions and maintain the security of the blockchain. Without miners, the Bitcoin network would be vulnerable to attacks, and the entire cryptocurrency ecosystem would be at risk.

Therefore, it is crucial to understand the role that miners play in the Bitcoin network and to appreciate the significant impact that mining has on the world of cryptocurrency. By gaining a comprehensive understanding of Bitcoin mining and the broader implications of mining operations, we can better appreciate the significance of this important process.

Final Thoughts

As the world of cryptocurrency continues to evolve and expand, Bitcoin mining will remain a critical process. By understanding the technical, economic, legal, and environmental aspects of Bitcoin mining, we can gain a comprehensive understanding of this essential process and its broader impact on the world of finance and technology.

At its core, Bitcoin mining is an innovative and exciting process that is helping to shape the future of finance and technology. By exploring the intricacies of Bitcoin mining, we can gain a deeper appreciation for the power and potential of this exciting technology.

FAQ

What is a Bitcoin miner?

A Bitcoin miner is a participant in the Bitcoin network who uses specialized hardware and software to solve complex mathematical problems. By solving these problems, miners validate transactions, maintain the integrity of the blockchain, and secure the network against potential attacks.

What is cryptocurrency mining?

Cryptocurrency mining is the process of validating and adding new transactions to a digital currency’s blockchain. Miners use powerful computers to solve complex mathematical problems, which helps maintain the integrity of the blockchain and secure the network.

How does Bitcoin mining work?

Bitcoin mining involves the use of specialized hardware known as ASIC miners to solve complex mathematical problems. Miners compete to find a solution, and the first miner to find the solution is rewarded with newly minted bitcoins. This process ensures the security and integrity of the Bitcoin network.

What is the role of miners in the Bitcoin network?

Miners play a crucial role in the Bitcoin network. They validate transactions, maintain the integrity of the blockchain, and secure the network against potential attacks. Miners ensure that transactions are legitimate and prevent double-spending, making Bitcoin a trusted decentralized currency.

How do I mine Bitcoin?

To mine Bitcoin, you will need specialized hardware, such as ASIC miners, and mining software. The software connects your hardware to the Bitcoin network, allowing you to participate in the mining process. Mining Bitcoin requires significant computational power and access to cheap electricity to be profitable.

Are there any legal considerations when it comes to Bitcoin mining?

The legality of Bitcoin mining varies from country to country. While many countries allow and regulate mining operations, some have restrictions or outright bans. It is important to familiarize yourself with the legal landscape in your jurisdiction before engaging in Bitcoin mining.

What are the financial incentives for Bitcoin miners?

Bitcoin miners are rewarded with newly minted bitcoins for their mining efforts. These rewards serve as an incentive for miners to dedicate their computational power to secure the network. Additionally, miners may earn transaction fees from the transactions they include in the blocks they mine.

What are the environmental impacts of Bitcoin mining?

Bitcoin mining consumes a significant amount of electricity, leading to concerns about its environmental impact. The energy consumption of mining operations and the associated carbon footprint have raised questions about the sustainability of cryptocurrency mining. Efforts are underway to make mining more energy-efficient and environmentally friendly.

What are the potential risks and challenges in Bitcoin mining?

Bitcoin mining faces various risks and challenges. These include the potential for mining centralization, where a small number of miners control a significant portion of the network’s computational power. Other risks include 51% attacks, hardware becoming outdated, and the volatility of the cryptocurrency market.