Bitcoin, the world’s first and most prominent cryptocurrency, has garnered immense attention since its inception in 2009. Its meteoric rise in value has captivated the financial world, leaving many wondering about the underlying factors that drive its worth. This article delves into the intricacies of Bitcoin’s value, exploring both its intrinsic and extrinsic attributes that contribute to its perceived worth.

Intrinsic Value: The Foundation of Bitcoin’s Worth

Bitcoin’s intrinsic value stems from its inherent characteristics and functionalities. Unlike fiat currencies, which are subject to central bank manipulation and inflationary pressures, Bitcoin possesses a finite supply of 21 million coins, a feature that imparts scarcity and a hedge against inflation. This limited supply is written into the code of Bitcoin and cannot be altered, making it a deflationary currency.

Furthermore, Bitcoin operates on a decentralized network, eliminating the need for intermediaries and empowering individuals to control their own finances. This decentralized nature fosters trust and transparency, as all Bitcoin transactions are immutably recorded on a public blockchain. This means that there is no central authority controlling the flow of Bitcoin, making it a truly peer-to-peer currency.

Utility as a Medium of Exchange and Store of Value

Bitcoin’s utility as a medium of exchange and store of value further enhances its intrinsic value. Its borderless nature and resistance to censorship make it an attractive alternative to traditional financial systems. With Bitcoin, users can send and receive money anywhere in the world without the need for banks or other intermediaries. This makes it a more efficient and cost-effective option for international transactions.

Moreover, Bitcoin’s limited supply and decentralized nature also make it a viable store of value. As mentioned earlier, its finite supply acts as a hedge against inflation, making it a more stable store of value compared to fiat currencies. Additionally, its decentralized nature means that it is not subject to government interference or manipulation, making it a more secure option for storing wealth.

Extrinsic Value: Factors that Influence Bitcoin’s Price

While intrinsic value forms the foundation of Bitcoin’s worth, there are also extrinsic factors that influence its price. These include market demand, adoption, and speculation.

Market Demand

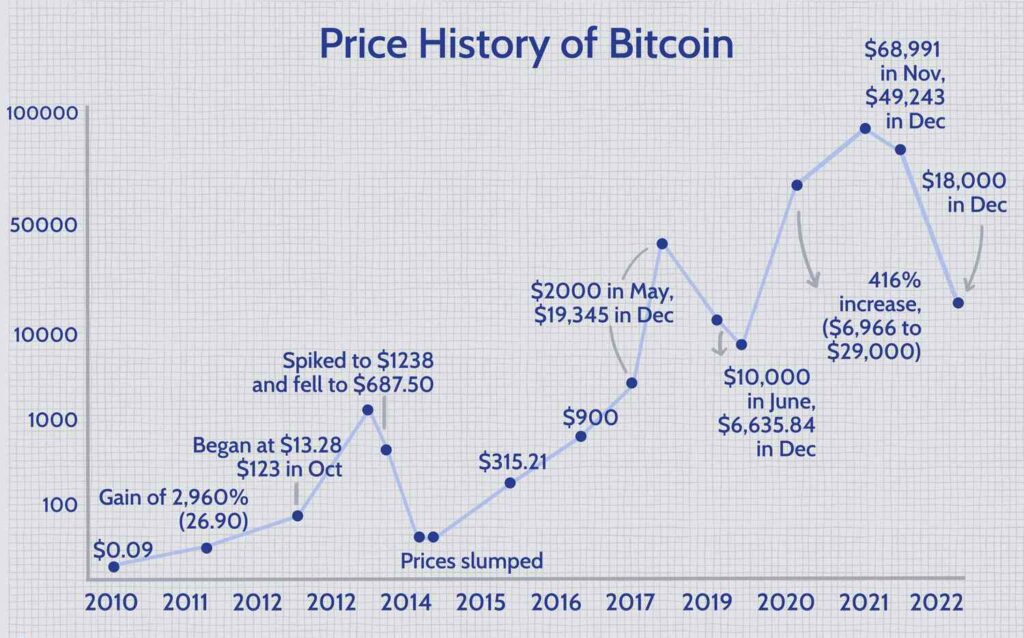

Market demand plays a significant role in determining the price of Bitcoin. As with any asset, when there is high demand and limited supply, the price tends to increase. This has been evident in Bitcoin’s history, with its price surging during periods of high demand, such as the bull run of 2017.

Moreover, as Bitcoin becomes more mainstream and accepted as a legitimate form of currency, its demand is likely to increase. This can be seen in recent years, with more companies and institutions investing in Bitcoin and accepting it as a form of payment. This increased demand has contributed to the rise in Bitcoin’s price.

Adoption

The level of adoption also impacts Bitcoin’s price. As more people and businesses start using Bitcoin, its value increases. This is because increased adoption leads to a larger network effect, where the more people use Bitcoin, the more valuable it becomes. Additionally, as more merchants accept Bitcoin as a form of payment, it becomes more useful and valuable as a medium of exchange.

Furthermore, adoption by institutional investors and large corporations can also have a significant impact on Bitcoin’s price. This was evident in 2020 when companies like MicroStrategy and Square invested millions of dollars in Bitcoin, causing its price to surge.

Speculation

Speculation is another factor that influences Bitcoin’s price. Due to its volatile nature, many investors see Bitcoin as a speculative investment, buying and selling based on short-term price movements. This can lead to significant price fluctuations, as seen in the past when Bitcoin’s price reached an all-time high of nearly $20,000 in 2017, only to drop below $4,000 a year later.

Moreover, the media and social media can also play a role in fueling speculation. Positive news coverage or influential figures endorsing Bitcoin can lead to increased demand and, therefore, a rise in its price. On the other hand, negative news or FUD (fear, uncertainty, and doubt) can cause panic selling and a decrease in Bitcoin’s value.

Will Bitcoin Halving Increase Price?

One significant event that has a direct impact on Bitcoin’s price is the halving. Bitcoin halving is a pre-programmed event that occurs every four years, where the number of new Bitcoins created with each block mined is reduced by half. This means that the supply of new Bitcoins entering the market decreases, leading to a decrease in inflation and an increase in scarcity.

Historically, Bitcoin halvings have been followed by a surge in its price. The first halving occurred in 2012, and within a year, Bitcoin’s price had increased from around $12 to over $1000. Similarly, after the second halving in 2016, Bitcoin’s price rose from around $650 to nearly $20,000 in 2017.

The third halving took place in May 2020, and while it did not result in an immediate price surge, many experts believe that its effects are yet to be seen. Some predict that the current bull run in late 2020 and early 2021 is a result of the third halving, and we may see even higher prices in the future.

Why is Bitcoin’s Price Dropping?

As with any asset, Bitcoin’s price is subject to market forces and can experience periods of volatility. In recent months, there has been a lot of speculation about why Bitcoin’s price has been dropping, with some attributing it to Elon Musk’s tweets and China’s crackdown on cryptocurrency mining.

However, it is essential to note that price drops are a normal part of Bitcoin’s market cycle. In the past, we have seen significant price drops, such as the one in 2018 when Bitcoin’s value dropped by over 80%. These drops are often followed by periods of growth and stability.

Moreover, the recent drop in Bitcoin’s price can also be attributed to profit-taking by investors who bought in at lower prices. As with any asset, when there is a sudden surge in price, some investors may choose to sell and take their profits, leading to a temporary drop in price.

How is Bitcoin’s Value Determined?

Bitcoin’s price is determined by the forces of supply and demand. As mentioned earlier, when there is high demand and limited supply, the price tends to increase. On the other hand, when there is low demand and an oversupply of Bitcoin, the price may decrease.

Additionally, Bitcoin’s price is also influenced by market sentiment, news, and events. Positive news or developments in the cryptocurrency space can lead to increased demand and, therefore, a rise in price. Similarly, negative news or regulatory actions can cause a decrease in demand and, consequently, a drop in Bitcoin’s value.

Furthermore, technical analysis is often used to predict Bitcoin’s price movements. This involves studying charts and patterns to identify trends and make predictions about future price movements. However, it is essential to note that technical analysis is not always accurate and should not be relied upon solely for investment decisions.

| Next Up In Investing |

| How Does Bitcoin Work |

| How to Read Bitcoin Charts |

| How Many Bitcoins for a Dollar? |

Conclusion

In conclusion, Bitcoin’s value is determined by both intrinsic and extrinsic factors. Its scarcity, decentralization, and utility as a medium of exchange and store of value contribute to its intrinsic value. On the other hand, market demand, adoption, and speculation influence its price. While Bitcoin’s price may experience periods of volatility, its long-term trend has been one of growth, making it a valuable asset for investors. As the cryptocurrency space continues to evolve, it will be interesting to see how Bitcoin’s value and price are impacted in the future.

source: mdpi