What Is a CEX? In recent years, the cryptocurrency industry has surged in popularity, drawing interest and caution due to inherent risks and rapid price fluctuations. To trade cryptocurrencies, users need accounts on centralized exchanges (CEX) or decentralized exchanges (DEX).

This article focuses on explaining centralized exchanges, where a central authority oversees transactions, and briefly touches on decentralized exchanges, which operate peer-to-peer.

| Next Up In Investing |

| What is USDT? How to Buy |

| What is USDC? How to Buy |

| What Is a DEX? Decentralized Exchange |

| What is a Cryptocurrency Exchange? |

What is a CEX (Centralized Cryptocurrency Exchange)?

Ever wondered, “What is a centralized exchange?” Let’s delve into the world of centralized crypto exchanges, also known as CEXs, where the excitement of cryptocurrency trading comes to life. Imagine an online platform designed for trading digital assets, and you’ve got a centralized exchange. As the name implies, these platforms operate under the watchful eye of a centralized authority, typically the company that brought them into existence. In fact, centralized exchanges were the pioneers of the crypto trading landscape.

Initially, CEXs were shrouded in anonymity, allowing users to navigate the crypto market incognito. However, with the surge in user numbers, global financial regulators raised concerns about the potential misuse of anonymity. Consequently, the landscape evolved, and users are now required to verify their identities before engaging in trades.

Centralized exchanges go beyond basic trading; they elevate your experience by offering a plethora of order options. From limit orders to stop-loss orders, stop-limit orders, and even venturing into margin and leverage trading, these platforms cater to diverse trading styles. Safeguarding your assets is a top priority for most exchanges, with the majority storing their assets in cold storage. This ensures that assets remain offline, impervious to online threats. The only vulnerable funds are those residing in hot wallets.

Hot wallets play a crucial role in ensuring liquidity and safeguarding users’ assets. It’s highly advisable to withdraw your funds once your trading session concludes. By transferring your assets back to your private wallet, you add an extra layer of security, making it significantly more challenging for potential theft. Despite the evolving landscape, centralized exchanges boast robust security protocols, ensuring the safety of your funds.

Now, let’s break down the intricacies of CEXs, addressing the core question: “What is a CEX?”

Understanding the CEX Landscape

| Centralized Exchange Features | Details |

| Anonymity Evolution | CEXs initially offered anonymity, but global regulators prompted a shift towards identity verification. |

| Order Variety | Explore a range of order types, from limit orders to stop-loss, stop-limit, and advanced features like margin and leverage trading. |

| Asset Security | Most exchanges prioritize security, with the bulk of assets stored in offline cold storage for protection against cyber threats. |

| Hot Wallets | These wallets support liquidity and user asset protection, emphasizing the importance of timely fund withdrawal. |

| Safety Protocols | Centralized exchanges implement robust security measures to safeguard users’ funds and ensure a secure trading environment. |

Features of a Centralized Exchange

Ever wondered about the distinctive features that define a centralized exchange, often abbreviated as CEX? Let’s unravel the intricacies of these platforms and understand what sets them apart in the dynamic world of cryptocurrency trading.

Centralized Governance for Swift Operations

At the heart of a centralized exchange is its governance structure—controlled by a single entity. This unique feature facilitates rapid decision-making and the efficient implementation of strategies. The consequence? A more streamlined and responsive service delivery. Centralized exchanges leverage this setup to provide users with advanced trading tools, support for fiat currencies, simplified account management, and robust customer support. This strategic approach enables them to attract a large user base, resulting in higher trading volumes and increased liquidity. This, in turn, translates to faster trade executions and tighter bid-ask spreads.

However, the downside of centralization is the vulnerability it introduces. With a single entity in control, any issue, whether technical glitches, server outages, or financial difficulties, can have widespread repercussions. Moreover, being subject to specific regional regulations exposes users’ funds to potential regulatory actions, particularly concerning in regions with stringent laws.

The aspect of trusting a centralized entity for fair and honest trade execution introduces risks such as front-running, market manipulation, and even insider trading. Additionally, the opacity of company policies raises concerns, as users may not fully comprehend the principles guiding the exchange’s operations.

Custodial Wallets: Balancing Security and Control

Security measures are paramount for centralized exchanges, encompassing password protection, two-factor authentication (2FA), cold storage, withdrawal restrictions, and regular security audits. However, a notable trade-off arises with the use of custodial wallets. While these measures safeguard users’ funds and personal information, they require depositing funds into accounts under the exchange’s control. Users receive login details but don’t truly own the wallet; the exchange holds the private key, and users essentially “borrow” the wallet for transactions and crypto storage. This lack of ownership introduces the risk of the centralized entity revoking access at any point, emphasizing the importance of transferring funds to non-custodial wallets, as recommended by platforms like Kraken.

Mandatory KYC: Balancing Privacy and Compliance

Finally, centralized exchanges necessitate Know Your Customer (KYC) processes, requiring users to submit official documents for identity verification. This compliance with local laws is essential for these business entities. However, it comes at the cost of user privacy, compelling individuals to share sensitive information with centralized entities.

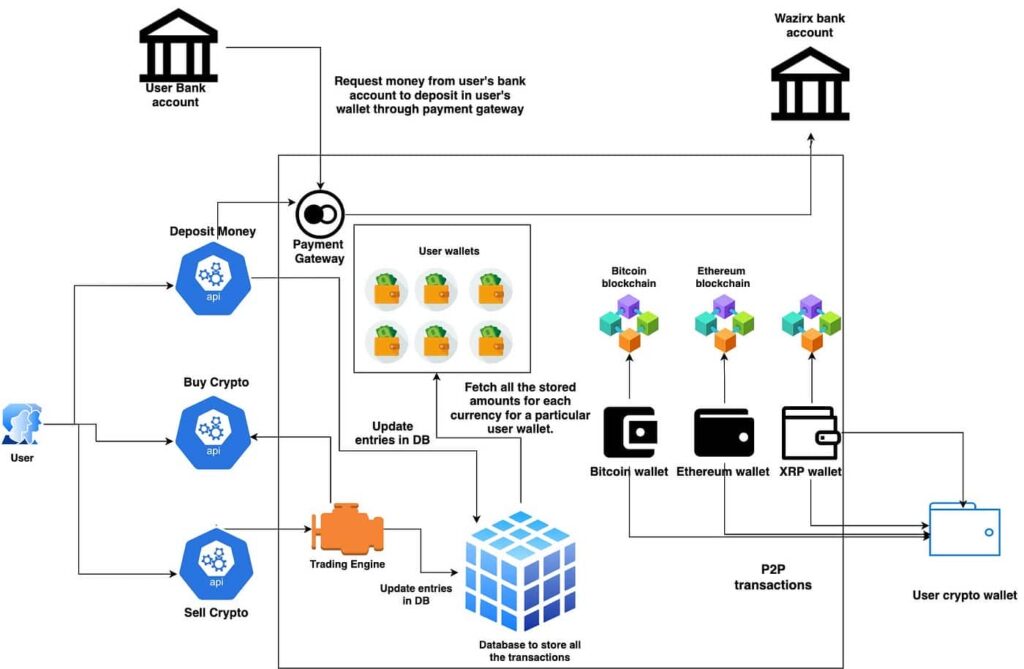

How Do CEX Work?

Ever wondered how a CEX operates? It’s a straightforward process, mirroring the user-friendly practices found in traditional finance. To begin, you’ll need to create an account, undergo identity verification, and deposit funds. Once these steps are completed, you gain the freedom to engage in trading activities.

Trading on a CEX involves submitting a market order, which becomes part of the platform’s order book. The order book stores these requests until a corresponding sell order emerges. When a matching sell order is identified, a seamless trade execution takes place.

Similar to traditional finance structures, where maker and taker fees are commonplace, crypto trading on centralized exchanges also entails transaction fees. Remarkably, these transaction fees serve as the primary revenue stream for centralized exchanges, aligning with the established practices of their traditional counterparts.

Let’s delve into the key aspects of CEX functionality:

CEX Operation Process

| Step | Description |

| 1. Account Creation | Users initiate the process by opening an account on the CEX platform. |

| 2. Identity Verification | Verification protocols ensure the security of user accounts by confirming their identities. |

| 3. Fund Deposits | Users deposit funds into their accounts to facilitate trading activities. |

| 4. Trading Execution | Trading is executed by submitting market orders, stored in the platform’s order book until matched with a corresponding sell order. |

Transaction Fees: The Financial Backbone

| Fee Type | Description |

| Maker Fee | Applicable when users provide liquidity to the market by placing limit orders. |

| Taker Fee | Incurred when users execute market orders, consuming liquidity from the order book. |

| Primary Income Source | Transaction fees constitute the primary revenue for centralized exchanges. |

In essence, understanding the mechanics of centralized exchanges empowers users to navigate the crypto trading landscape efficiently. As you embark on your trading journey, grasp the significance of account creation, identity verification, and the pivotal role transaction fees play in sustaining the operational backbone of CEXs.

Centralized Vs. Decentralized Exchanges (CEX VS DEX): What’s The Difference?

As users crave more control over their assets, decentralized exchanges (DEX) have surged in popularity. Unlike centralized exchanges (CEX), DEX replaces the traditional order book with an Automated Market Maker (AMM) model, simplifying crypto trading by using smart contracts and liquidity pools.

In contrast to CEX, where the exchange holds wallet private keys, DEX prioritizes user control. Utilizing non-custodial wallets, users connect to a DEX, using their private keys for seamless trading and fund management.

Let’s quickly compare the key features of CEX and DEX:

CEX vs. DEX: A Snapshot

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

| Trading Mechanism | Order book-based | Automated Market Maker (AMM) |

| Liquidity Provision | Centralized | Decentralized liquidity pools |

| Custodianship | Exchange controls | User retains control with non-custodial wallets |

| Autonomy | Limited | Enhanced user control |

Understanding this distinction empowers users to navigate the crypto landscape, choosing between centralized convenience and decentralized autonomy based on their preferences and goals.

Examples of CEX

In the dynamic realm of cryptocurrency trading, several centralized exchanges stand out as leaders, each with distinctive features:

- Binance (Founded: 2017):

- Global giant, hosting thousands of cryptocurrencies.

- Millions of users make it the world’s largest centralized exchange.

- Coinbase (Founded: 2012):

- Dominates the US market as the most widely used CEX.

- Publicly-traded with a user-friendly interface, albeit with relatively higher fees.

- Kraken (Founded: 2011):

- Renowned for trustworthiness and low fees.

- Preferred by intermediate and expert crypto users since its establishment.

Snapshot of Centralized Exchange Highlights:

| Exchange | Year Founded | Key Features |

| Binance | 2017 | Largest global exchange, extensive cryptocurrency offerings |

| Coinbase | 2012 | Leading US-based exchange, user-friendly interface, publicly-traded |

| Kraken | 2011 | Trusted global exchange, known for low fees |

These centralized exchanges play pivotal roles in shaping the crypto landscape, providing users with diverse options tailored to their preferences and expertise levels.

Do I Need To Use a Centralized Exchange?

Entering the world of cryptocurrency prompts a choice between centralized exchanges (CEX) and decentralized exchanges (DEX). If your aim is to buy crypto using traditional fiat like USD, a CEX is the practical route, as most DEXs don’t support fiat currencies.

For those new to crypto, initiating the journey often involves using a CEX and undergoing Know Your Customer (KYC) verification. But the question arises: “How can I buy crypto without surrendering control over my funds?”

Here’s a strategic approach:

- CEX for Fiat Purchase: Start on a CEX, using fiat to buy crypto and undergoing KYC if required.

- Transfer to Non-Custodial Wallet: Move your crypto to a non-custodial wallet, ensuring control over your private keys.

- Explore DEX Opportunities: Once in a non-custodial wallet, explore DEXs for further trading, benefiting from increased control.

This blend of CEXs and DEXs empowers you to navigate the crypto landscape, maintaining control and security over your assets. Balancing the strengths of centralized and decentralized exchanges lets you tailor your crypto journey to align with your preferences and long-term goals.

Using a Centralized Exchange Securely

Maintaining control of your crypto assets and private keys while using a centralized exchange (CEX) is straightforward with Ledger. Connect your Ledger device to Ledger Live for direct purchases via an on-ramp partner, ensuring ownership rights and flexibility in trading.

Alternatively, if you’ve already engaged with a CEX, enhance security by transferring assets to your Ledger. Set up a Ledger account, purchase on the CEX, and then transfer the assets, enjoying the heightened security provided by your Ledger device. Whether you opt for direct CEX transactions or asset migration, the goal is consistent — giving you control and peace of mind in your crypto journey.

In Conclusion: Centralized Exchanges Explained

As you navigate the diverse landscape of crypto exchanges, recognize that the power of self-custody defines the security of your assets. Whether you prefer the streamlined experience of a CEX or the control offered by a DEX, your commitment to security practices underscores the essence of self-custody in the cryptocurrency domain.

Source: http://aunilo.uum.edu.my/Find/Record/my-utar-eprints.6095/Description