What is USDT? USDT, or Tether, is a cryptocurrency tethered to the US dollar, maintaining a stable value of $1. Issued by Tether Limited and backed by US dollars and other assets, USDT is widely utilized in the volatile crypto markets.

Traders value it for storing assets, hedging against price fluctuations, and facilitating seamless international transfers. Despite occasional controversy surrounding its backing by Tether Limited, USDT remains a popular and versatile cryptocurrency globally.

| Next Up In Investing |

| What is USDC? How to Buy |

| What Is a CEX? Centralized Exchanges Explained |

| What Is a DEX? Decentralized Exchange |

| What is a Cryptocurrency Exchange? |

What is USDT?

USDT, or Tether, is a stablecoin cryptocurrency with tokens issued by Tether Limited. USDT is pegged to the US dollar, meaning each token is always worth $1.

Tether holds reserves that are meant to back each USDT token 1:1 with traditional currency. This allows USDT to maintain a stable valuation, unlike other cryptocurrencies that fluctuate wildly.

USDT is built on top of several blockchain networks, including Bitcoin, Ethereum, Tron, EOS, Algorand, Solana, and OMG. The most popular versions are based on Ethereum’s ERC-20 standard, known as ERC-20 USDT, and Tron’s TRC-20 standard, known as TRC-20 USDT.

Some key things to know about Tether:

- Pegged to US Dollar – Each USDT token is worth $1 USD. This stable price allows it to function as a digital dollar.

- Reserves – USDT is backed by reserves of assets including cash, cash equivalents, and other short-term securities.

- Blockchains – USDT operates on top of several blockchains, most commonly Ethereum and Tron.

- Controversy – There have been questions about the true extent of USDT’s dollar reserves. Tether settled with the NY Attorney General in 2021.

- Popularity – Despite controversies, USDT remains one of the most widely used stablecoins with a market cap of over $70 billion.

USDT provides stability, liquidity, and a simple medium of exchange in the cryptocurrency ecosystem. But proper due diligence is recommended before using any cryptocurrency, including evaluating risks and transparency.

What is a USDT Wallet?

A USDT wallet is a digital wallet that allows you to store, send, and receive USDT tokens. There are many different types of USDT wallets available, including:

- Hardware wallets like Ledger and Trezor – Provide offline storage and high security for USDT.

- Software wallets like Exodus and Atomic – Offer convenience and integration with other blockchain services.

- Mobile wallets like Trust Wallet and Coinbase – Allow USDT transactions on mobile devices.

- Exchange wallets like Binance and Coinbase – Good for active trading but higher risks than non-custodial wallets.

When choosing a USDT wallet, key factors to evaluate include security, ease of use, supported features, accessibility, and ownership model (custodial vs non-custodial).

It’s important to use a wallet where you control the private keys, not an exchange, for long term USDT storage. Reputable hardware wallets like the Ledger Nano provide top security. Software wallets or mobile wallets like MetaMask or Trust Wallet also give you control over keys while offering convenient access.

How Does Tether Work?

Tether works by having Tether Limited issue new USDT tokens whenever customers purchase them. These tokens are meant to be backed 1-to-1 by Tether’s reserves.

For example, if you sent Tether $1000, they would create 1000 new USDT tokens and send them to your wallet address. The creation of new tokens is recorded on the respective blockchain network like Ethereum.

Tether’s reserve assets are intended to guarantee the redemption of USDT tokens. You can supposedly always redeem 1 USDT for $1 of assets from Tether Limited. In practice, most USDT is traded on exchanges against other crypto.

The validity of Tether’s reserves has been disputed. Tether settled charges in 2021 that it misrepresented reserves for a period of time. Tether now provides occasional reserve attestations from accounting firms. But many still desire more frequent and thorough transparency audits.

Despite controversies, USDT remains popular for trading, transactions, and parking funds during downturns. The Tether “peg” has so far held at around $1. But risks remain around Tether’s opacity and centralization.

Tether History

Some key milestones in Tether’s history:

- 2014 – Released as Realcoin, the first stablecoin pegged to US dollar

- 2015 – Rebranded from Realcoin to Tether

- 2017 – Tether market cap surpassed $1 billion amid crypto boom

- 2018 – Questions emerged about whether Tether reserves fully backed USDT

- 2019 – NY Attorney General sued Tether for misrepresenting reserves

- 2021 – Tether settled with NYAG, paid fine, and provided reserve info

- 2022 – Tether remains a top stablecoin but faces ongoing criticism

For most of its history, Tether maintained that USDT tokens were 100% backed by sufficient reserves. But in 2019, this claim was challenged.

The New York Attorney General sued Tether and Bitfinex for misleadingly claiming full reserves. An investigation found Tether reserves only partially backed at certain times.

Tether ceased making “100% backed” claims. It instead provided occasional asset breakdowns and attestations to show it currently maintains adequate reserves. Questions around transparency and redemption still remain.

Through the controversy, Tether has become essential to crypto markets by providing a stable asset amid wild volatility. But concerns persist around its centralized control and opaque reserves.

How Is Tether Useful?

Here are some of the key uses that have made Tether popular:

Trading – USDT is widely used as a trading pair and quote currency on crypto exchanges. Its stability makes it ideal for this versus high volatility coins.

Payments – The stable $1 value and blockchain capabilities allow using USDT for payments, remittances, and tipping.

Liquidity – Abundant liquidity and volume make USDT popular for moving money between exchanges and wallets.

Stability – As a dollar-pegged stablecoin, USDT offers stability amid crypto market crashes.

Hedging – Traders often move holdings to USDT to hedge against crypto declines.

Arbitrage – Traders can exploit USDT price differences between exchanges for profit.

Decentralized Finance – USDT is widely integrated in DeFi lending, derivatives, liquidity pools, prediction markets, and more.

Despite its controversies, USDT brings utility to crypto users and traders due to its stability, liquidity, and ubiquity. However, prudent risk management is always wise when using any cryptocurrency.

Is USDT Safe?

On a day-to-day basis, sending and using USDT is generally quite safe. The technical risks are no more than any major cryptocurrency.

However, there are broader debates around USDT’s long-term safety:

- Reserves – Tether’s reserve transparency is lacking compared to rivals like USDC. This raises questions on backing.

- Regulation – Tether has been the subject of regulatory actions over transparency. More may come in the future.

- Peg stability – Tether has maintained its $1 peg so far. But a severe loss of faith could challenge this, similar to TerraUSD’s collapse.

- Centralization – Tether’s control over USDT is more centralized than algorithmic stablecoins.

So while USDT’s dominance shows it is currently safe for trading, there are risks to consider. Performing due diligence before investing is wise. And never leaving major funds on exchanges long term remains sound practice.

How to Buy USDT

There are a few options for buying USDT, including:

Cryptocurrency Exchanges – Most major crypto exchanges like Binance, Coinbase, Kraken, and KuCoin allow direct USDT purchases by depositing cash or buying with another crypto.

P2P Marketplaces – These allow buying USDT directly from other users. Examples include LocalBitcoins, Paxful, and Bisq.

Debit/Credit Cards – Some exchanges and P2P marketplaces permit buying USDT with debit or credit cards. Fees are usually higher.

Payment Apps – In some regions, USDT can be purchased inside payment apps like PayPal or Venmo. Availability is limited.

The easiest option is buying directly through a mainstream exchange like Coinbase. But P2P and decentralized platforms offer more privacy and less oversight.

It’s advised to withdraw USDT from exchanges to your own wallet for long-term storage. This gives you full control over the assets.

Where to Buy USDT

USDT can be purchased from various sources:

- Exchanges – Top options include Binance, Coinbase, Kraken, KuCoin. Verify identity, deposit funds, and trade for USDT.

- P2P Platforms – Buy from and sell to other users directly on platforms like LocalBitcoins, Paxful, Bisq. More privacy but higher risk.

- Brokers – Buy USDT with credit/debit cards and other payment methods through brokers like Coinmama, CEX.IO. Higher fees.

- Decentralized Exchanges (DEXs) – Swap other crypto assets for USDT anonymously on platforms like Uniswap and PancakeSwap.

- Crypto ATMs – Insert cash and receive USDT instantly from crypto ATMs in some cities. Fees are ~10%.

- Payment Apps – In select regions, USDT is available for purchase within apps like PayPal, Venmo, or Cash App.

For beginners, regulated fiat-to-crypto exchanges like Coinbase provide the simplest way to buy USDT. But more advanced venues like DEXs and P2P platforms offer advantages around fees, privacy, or accessibility.

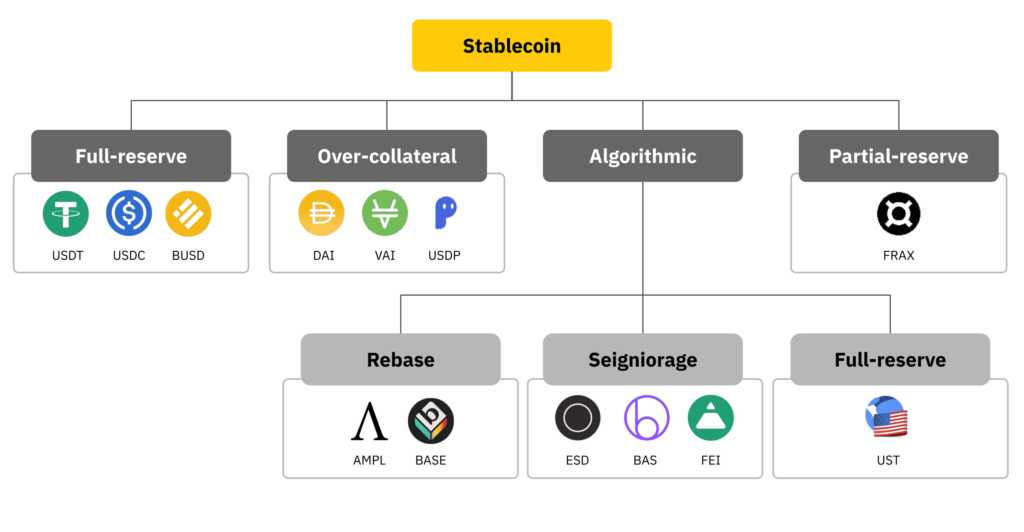

How USDT is different from other stablecoins

USDT paved the way for stablecoins but now faces an array of new competitors like USDC, BUSD, and DAI. Here are some key differences between USDT and other major stablecoins:

USDC – Fully transparent reserves. Regulated and insured. Less liquidity/adoption currently than USDT.

DAI – Algorithmic supply without centralized control. Volatile fees. Smaller market presence.

BUSD – Centralized like USDT but more transparency. Lower liquidity than USDT.

UST – Algorithmic but lost peg and collapsed in 2022. Damaged trust in stablecoins.

USDP – Paxos-issued. Regulated. No major adoption yet.

Compared to alternatives, USDT has first-mover advantage but lags in transparency and regulatory compliance. However, it still dominates trading volumes by a wide margin.

USDT vs. DAI

USDT and DAI share the goal of a stable asset but have key differences:

- Collateral – USDT is backed 1:1 with reserves. DAI uses crypto overcollateralization.

- Control – USDT is centralized. DAI is governed by holders.

- Fees – Redeeming USDT has no fees. DAI redemption fees fluctuate based on supply/demand.

- Transparency – DAI reserves are fully transparent on the blockchain. USDT reserves have opacity.

- Stability – Both have maintained stability so far. DAI fluctuates slightly based on fees.

- Adoption – USDT dominates adoption and trade volumes. DAI has a loyal niche following.

DAI arguably has better transparency and decentralization. But USDT’s first-mover lead and liquidity remain much greater in the crypto markets currently. DAI represents an alternative for those preferring its decentralized approach.

USDT vs. USDC

USDT and USDC have emerged as the top dollar-pegged stablecoins:

- Backing – Both are backed 1:1 with reserves. USDC has full transparency and is legally obliged to maintain this.

- Regulation – USDC is regulated with insured cash reserves. Tether is offshore without clear regulations.

- Volume – USDT has much higher trade volume and liquidity currently. But USDC has been gaining market share.

- Launch – Tether launched in 2014, with a first mover advantage. USDC launched in 2018.

- Issuer – Tether is issued by Tether Limited. USDC is issued by regulated consortium Centre.

- Concerns – Tether has faced questions on reserve validity. USDC is fully transparent.

For those valuing regulatory compliance and transparency, USDC tends to be viewed as the safer choice. However, USDT still dominates trading volumes by a wide margin.

USDT vs. algorithmic stablecoins

Tether differs considerably from algorithmic stablecoins like UST and FRAX:

- Backing – USDT is backed 1:1 with reserves. Algorithmic coins use math to maintain the peg.

- Stability – USDT has been stable for 8+ years. UST lost its $1 peg in 2022. FRAX has been relatively stable.

- Control – Tether centrally mints and burns USDT. Algorithmic coins are decentralized.

- Redemption – USDT holders can redeem 1:1 with Tether. Algorithmic coins rely on arbitrage and incentives.

- Transparency – Tether reserves have gaps. Algorithmic reserves are on-chain.

- Adoption – USDT dominates adoption. Algorithmic coin usage is still developing.

Tether’s approach sacrifices decentralization but has so far worked to maintain stability and usage. Algorithmic coins offer financial experimentation and innovation, but risk stability failures like UST’s collapse.

Tether and the TerraUSD Meltdown

The collapse of algorithmic stablecoin TerraUSD (UST) in 2022 had ripple effects on Tether:

- Caused some USDT selling pressure as traders rotated into stablecoins perceived as safer, like USDC. But Tether maintained its ~$1 peg throughout.

- Raised fresh concerns about whether all stablecoins are truly stable long-term, or if USDT could face similar issues.

- Demonstrated the inherent risks and fragility of algorithmic stablecoins lacking reserves.

- Resulted in large losses for major USDT holders like Celsius Network who had UST exposure.

- Spurred calls for more transparency and regulation around all stablecoins to prevent stability crises.

The UST de-pegging highlighted that stablecoins carry unique risks compared to fiat currency. It emphasized the importance of due diligence before investing. But USDT’s dominance shows most traders still largely trust in its 1:1 dollar peg after UST’s failure.

Tether vs. Bitcoin

While both are cryptocurrencies, Tether and Bitcoin serve very different purposes:

- Stability – Tether is stable at $1. Bitcoin is highly volatile, with frequent double-digit price swings.

- Use cases – Tether facilitates trading and payments. Bitcoin is more focused on store of value and investment.

- Backing – Tether is backed by reserves. Bitcoin relies on math and decentralization for value.

- Supply – Tether increases supply based on demand. Bitcoin has fixed supply from mining.

- Transactions – Tether offers faster, cheaper transactions. Bitcoin has slower, more expensive on-chain transfers.

- Centralization – Tether is centrally controlled by its issuer. Bitcoin is decentralized across its network.

Tether aims to function as a digital dollar useful for trading and payments. In contrast, Bitcoin seeks to be “digital gold” as a scarce speculative asset and inflation hedge.

How to Convert USDT to USD

There are a few ways to convert your USDT to USD:

- Exchanges – The easiest way is to trade or sell your USDT for USD on exchanges like Coinbase, Kraken, or Gemini. They’ll deposit cash to your linked bank account.

- P2P Platforms – You can sell USDT for cash to buyers on sites like LocalBitcoins or Paxful. Transfer the money via payment apps, bank transfer, etc.

- Tether Direct Redemption – If you have very large amounts, you can supposedly redeem USDT 1:1 directly with Tether Limited to get USD.

- Debit Cards – Some platforms like Crypto.com or BitPay allow you to load USDT onto their debit card to spend like cash.

- Merchant Payments – Find merchants accepting USDT as payment, and they may give you USD change back. Limited adoption currently.

For most purposes, selling or exchanging USDT for USD on a major exchange is the most straightforward approach, though alternatives offer more privacy or more direct access to cash.

Key Points About USDT Currency

In summary, key things to know about Tether’s USDT stablecoin:

- USDT tokens are meant to be pegged 1:1 to USD by reserves backing each token issued

- Operates on various blockchains, especially Ethereum and Tron networks

- Questions exist about reserves and regulation, but peg has held so far

- Useful for trading, payments, converting between cryptocurrencies

- Stability and liquidity made it a popular stablecoin despite lack of transparency

- Competitors like USDC emerging but USDT maintains dominance for now

- Overall convenient and stable but prudent to assess risks fully before investing

Understanding the nuances of major cryptocurrencies like Tether helps inform sound investing and usage decisions in the turbulent crypto landscape.

TRC20

TRC20 is a technical standard used for smart ## Trust Wallet

Trust Wallet is a popular mobile wallet app that supports USDT and many other cryptocurrencies. Some key things to know:

- Provides a user-friendly mobile interface for managing crypto assets

- Supports both ERC20 and TRC20 USDT, along with many other tokens

- Allows buying crypto with credit/debit cards and exchanging between assets

- Integrates with Web3 DApps through WalletConnect

- Backed by Binance but non-custodial – you control your keys

- Available as free download for iOS and Android devices

Trust Wallet provides a convenient way to store, send, and receive USDT alongside other cryptocurrencies in a secure mobile wallet. The app balances usability and security, making it appealing for beginner and advanced users alike.

MetaMask

MetaMask is one of the most popular Web3 software wallets and supports USDT:

- Browser extension wallet that works with Chrome, Firefox, Brave, etc.

- Lets you securely manage Ethereum, Tron, and other blockchain assets and dApps

- Supports ERC20 USDT on Ethereum and TRC20 USDT on Tron networks

- Seamless integration with many DeFi and Web3 platforms

- Open source and non-custodial – gives users full control of keys

- Customizable with plugins and themes to tailor experience

With MetaMask’s broad platform support and customization options, it’s a versatile choice for using USDT and accessing decentralized apps. Its large user base also provides a strong foundation for security.

Is Tether a Good Investment?

Tether aims to act as a neutral stable asset rather than as an investment with returns. However, there are pros and cons to consider:

Potential Pros

- Functions as a safe haven during crypto market turmoil

- Useful tool for trading and moving between cryptocurrencies

- Backed by sufficient reserves to maintain the $1 peg (reportedly)

- Established history since 2014 and major adoption

Potential Cons

- No interest or investment returns like other crypto assets

- Ongoing lack of transparency around reserves

- Regulatory risks remain a concern

- Reliant on faith in Tether Limited to uphold redemption

Conclusion

For traders and businesses, USDT provides stability and convenience amid crypto volatility. However, risks around transparency and centralization remain. USDT is best suited as a short-term tool, while other stablecoins like USDC may be preferable for longer-term stability.

Ultimately, it’s important to carefully assess the risks and your personal investment goals before deciding if USDT is a good fit for you.