Bitcoin is about to pop for the fourth time in its 15 year history.

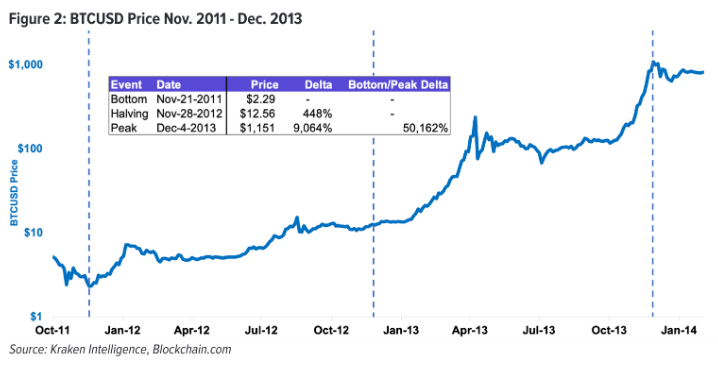

From November 2011 to Dec of 2013, bitcoin prices jumped to an incredible 50,162.01% from $2.29 per BTC to $1,151 per BTC.

Could this happen again? And soon?

Right now a similar situation is brewing, one that’s likely to produce a déjà vu event with a whopping price jump.

The event is simple: In less than two months, the reward for mining new Bitcoin blocks is cut in half. This process was coded into Bitcoin’s protocol to control its supply and to maintain its fixed scarcity of 21 million BTC.

Remember, in computer language, code is law. So the bitcoin halving event will happen like clockwork regardless of whether Satoshi Nakamoto likes it or not. It does not come down to the whimsical choice of a central figurehead like Jay Powell who runs the Federal Reserve.

And with the Spot Bitcoin ETF already available in the United States, this could allow many high-net-worth individual (HNWI), corporations and institutions to buy hundreds of billions of Satoshis’ small denominations of BTC with just a click of a button.

It’s a game changer and you haven’t missed the boat. So get ready to profit from this play!

Let’s dig deeper to understand what is the Bitcoin Halving right here.

- The Bitcoin Halving Explained

- The Bitcoin Connectome

- Historical Analysis of Bitcoin Halvings

- 2012 – 1st Halving

- 2016 – 2nd Halving

- 2020 – 3rd Halving

- 2024 – 4th Halving

- The Bitcoin Halvening: Key Numbers

- The Bitcoin Code that Enforces the Halving Event

- Bitcoin as a Store of Value

- The Scarcity of Bitcoin

- Why Are Halvings Important to SF?

- Is Bitcoin Designed to Rise Every Four Years?

» What Happens To My Bitcoin During / After the Halving Event?

Your bitcoins sitting in your wallet don’t get affected. The Halving implies that miners’ reward in bitcoins (BTC) get cut in half. Which means this Halvening event in May would reduce miner’s incentive from 6.25 new BTC to 3.125 new BTC every 10 minutes.

For context,

- before The Bitcoin Halving on April, 2024; there are 900 BTC released per day.

- after The Bitcoin Halving on April, 2024; there will be 450 BTC released per day.

A reduction in bitcoins being released considering demand is equal before and after the Bitcoin Halving could mean only one thing; Price goes up ↑

Historically, this was the effect in the prior two Halvenings’. However, the shock in bitcoin supply production normally takes about a year and a half before reflecting in the price. Information asymmetry seem to be a crucial determining factor.

It’s a strange game where the only winning move is to play. The more time it takes for you to understand Bitcoin, the less you get to realize its full benefits.

The Bitcoin Halving Explained

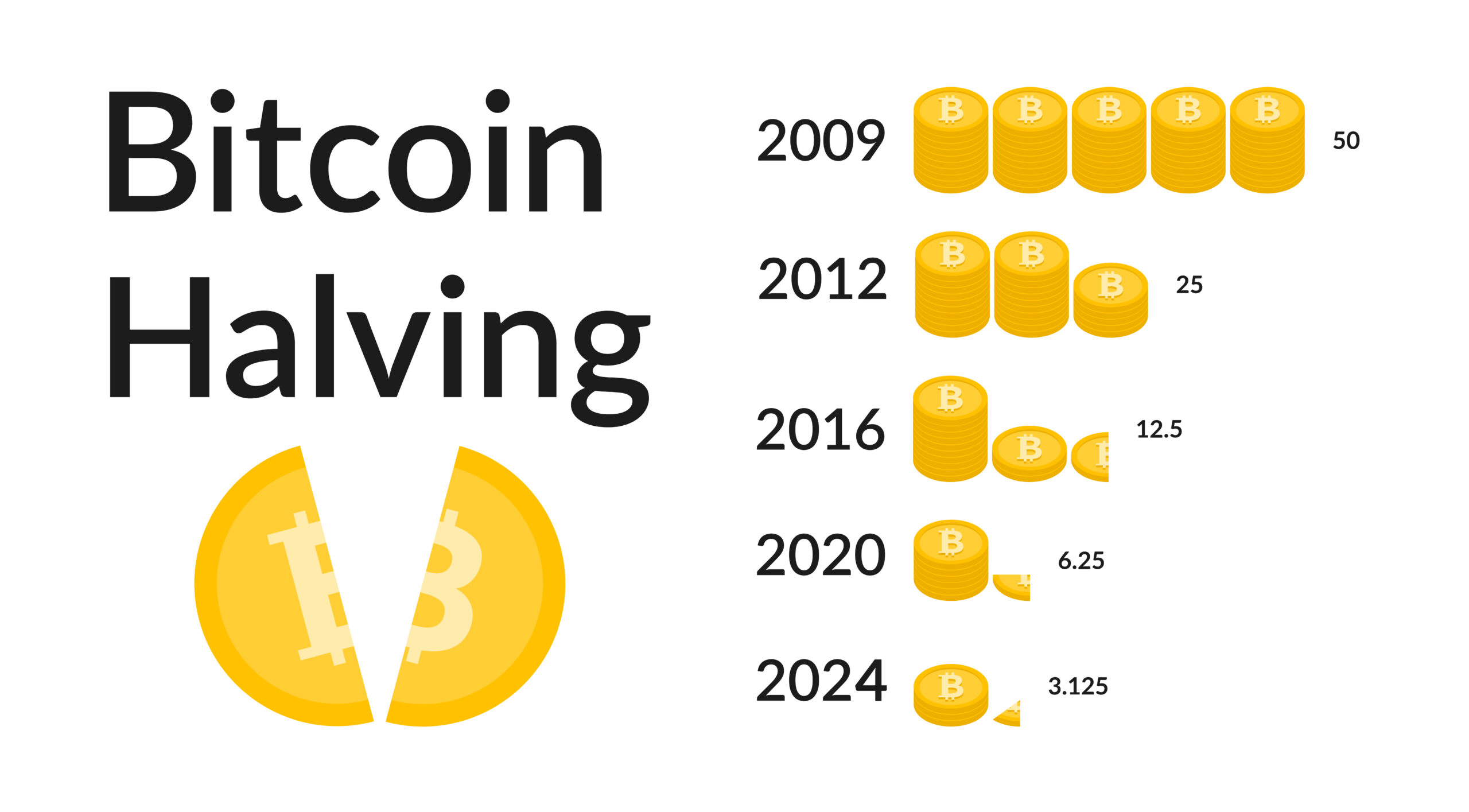

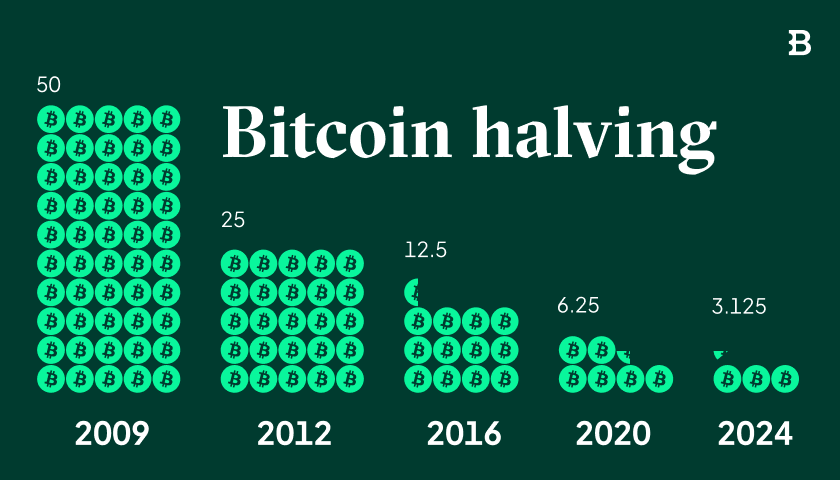

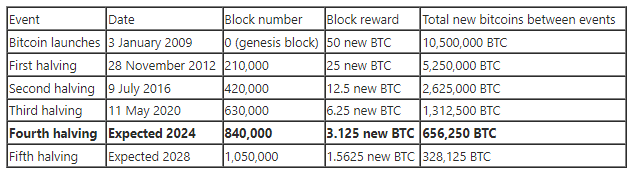

To help you visualize, here’s a graph illustrating the historical Bitcoin block rewards leading up to the halving event:

Bitcoin’s fourth halving falls in April, 2024.

What is it and why is it a significant talking point lately?

Essential to Bitcoin’s value proposition as a scarce digital asset, the halving draws global attention every 4-year interval. Like dangling a carrot in front of a donkey.

Unfortunately, it’s often a difficult concept to understand…

Even more so to act upon all the information freely available on the internet.

So to help you better understand its potential impact on the economy, I’ve taken time out of my business to write to you about its powerful implications.

And how the Bitcoin Revolution will not need centuries to materialize.

It would only take a decade or so!

In just one page, this article aims at giving beginners a succinct yet comprehensive analysis of the halving, covering a range of topics, including:

- Historical analysis of the first two halvings: You’ll get an overview of price activity surrounding the first two halvings, including charts and an analysis of the patterns common to both.

- Bitcoin as a store of value: Understand the connection between the halving and Bitcoin’s monetary policy, and how disinflationary assets have proven to be a better store of value over time.

- The scarcity of Bitcoin: Learn how scarcity is commonly measured by the stock-to-flow (SF) ratio and see how Bitcoin’s SF ratio is affected by the next halving. Also, see how Bitcoin’s SF ratio compares to gold and other commodities.

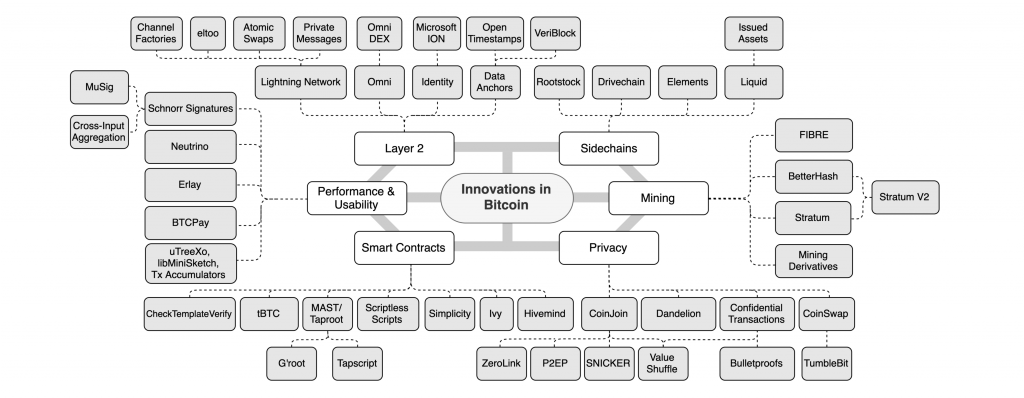

The Bitcoin Connectome

source @stopanddecrypt

The Bitcoin Network is a lot like a giant brain.

This brain specializes in preserving its evolutionary past … it keeps a copy of every single bitcoin transaction ever since the day it was born 15 years ago. (3rd January, 2009)

Why? To ensure transaction immutability. (ensures no one can tamper the ledger.)

Each red dot is what you call a node.

Every node checks the entire chain to make sure each and every transaction and block follow the rules. If they don’t, they get rejected.

Here are examples of those rules, though there are many more:

- Blocks may only create a certain number of bitcoins.

- Transactions must have correct signatures for the bitcoins being spent.

- Transactions/blocks must be in the correct data format.

- Within a single block chain, a transaction output cannot be double-spent.

Double-spending means spending the same money twice. Double-spending is a potential problem in which the same digital currency can be spent more than once. This is possible because a digital token consists of digital information which can be reproduced relatively easily.

Satoshi Nakamoto solved the double-spent problem using proof-of-work within Bitcoin’s design.

To understand why Bitcoin’s blockchain network is similar to the internet architecture (and not like a mobile phone or an automobile), let’s Imagine New York City for a moment.

Most of the world’s great cities have grown haphazardly, little by little, in response to the needs of the moment; very rarely is a city planned for the remote future.

Most of the world’s great cities have grown haphazardly, little by little, in response to the needs of the moment; very rarely is a city planned for the remote future.

In New York City, many of the streets date all the way back to the 17th century… the stock exchange to the 18th…the waterworks and the electrical power system to the 19th century.

And the communications bandwidth to the 20th.

New infrastructure is built on top of the original base layer to improve upon the existing network.

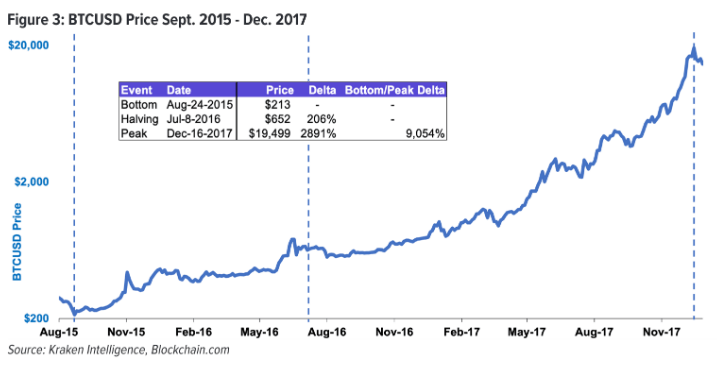

Source @LucasNuzzi

Bitcoin is like a city: it develops from a small center and slowly grows and changes, leaving many old parts still functioning.

New York can’t afford to suspend its water supply, or its transportation system, while they’re being improved by something more efficient.

Changes have to happen piecemeal.

Changes have to happen piecemeal.

And that’s how it is for Bitcoin.

Over time, the network becomes larger and larger as more people, corporations and institutions make it their home city.

There is no way for evolution to rip out the ancient interior of the brain because of its imperfections and replace it with something of more modern manufacture.

Once the network is large enough, it exerts its own gravitational force on every other mass until it reaches critical mass. It becomes self-sustaining, and no longer needs additional investment to remain economically viable.

The internet and Bitcoin share the near magical ability to communicate with any other no matter where they are, face to face. But there’s a big difference:

The internet communicates information.

Bitcoin communicates value.

Historical Analysis of Bitcoin Halvings

Bitcoin has only been around for a little over a decade, but it’s already catching fire. Every investor is now looking to add at least 6% of their portfolio to bitcoin.

Historically, the Bitcoin Halving has proven to be a huge catalyst for bullish price actions.

This happens every 210,000 blocks like clockwork, roughly every 4-years to reduce the issuance of bitcoins until the fixed supply cap is reached at 21 million coins.

This is a very unique way of geometrically driving down the inflationary bitcoin supply.

The Bitcoin Halving plays a crucial role in attracting miners to further strengthen the network (due to the depletion in incentive) while at the same time entice speculators to buy and HODL more bitcoins as less and less new ones are being created.

This technology of creating digital absolute scarcity is the first of its kind. And it remains a very unique selling proposition for a new kind of money.

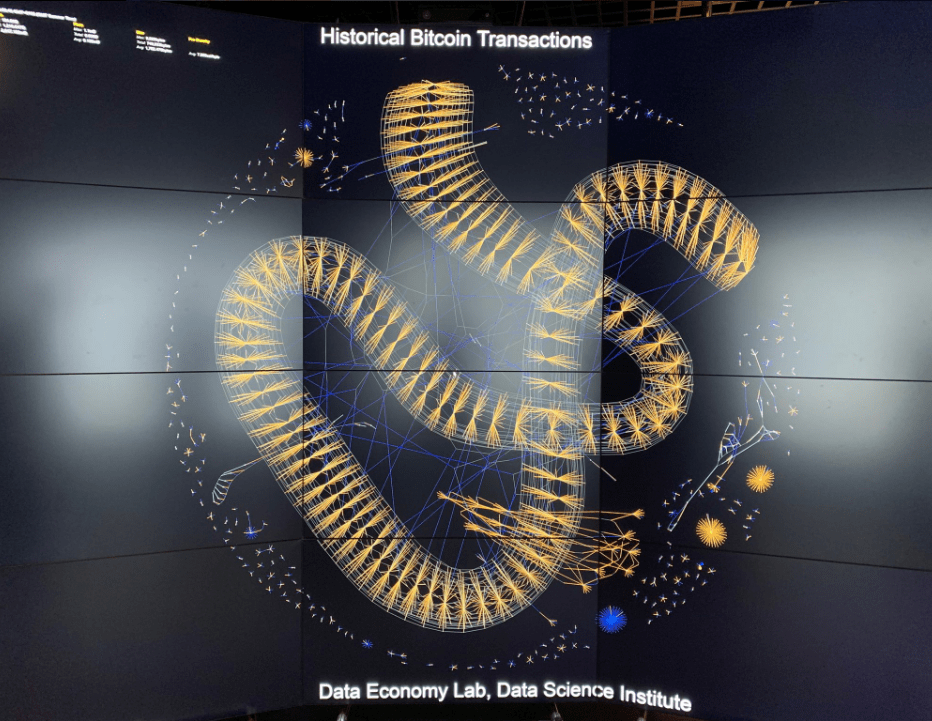

Data by Glassnode indicates the market size of Bitcoin today (one box) compared to gold (42 boxes) and the global currency supply (Over 120 boxes)

The relative size of Bitcoin’s current market cap compared to the existing financial market cap leaves a lot of upside to new investors even now.

Buying some just in case it catches on, makes perfect sense in the current economic climate.

𝗬𝗼𝘂 𝗮𝗿𝗲 𝘀𝘁𝗶𝗹𝗹 𝗲𝗮𝗿𝗹𝘆.

2012 – 1st Halving

The 2012 block halving was the first halvening that happened on November 28th, 2012. The halving reduced the reward for miners from 50 bitcoins to 25 bitcoins.

before this Bitcoin Halving; there were 7,200 BTC released per day.

after this Bitcoin Halving; there were be 3,600 BTC released per day.

- New BTC Per Block Before: 50 BTC per block

- New BTC Per Block After: 25 BTC per block

- Price on Halving Day: $12.56

- Price at peak: $1,151.00

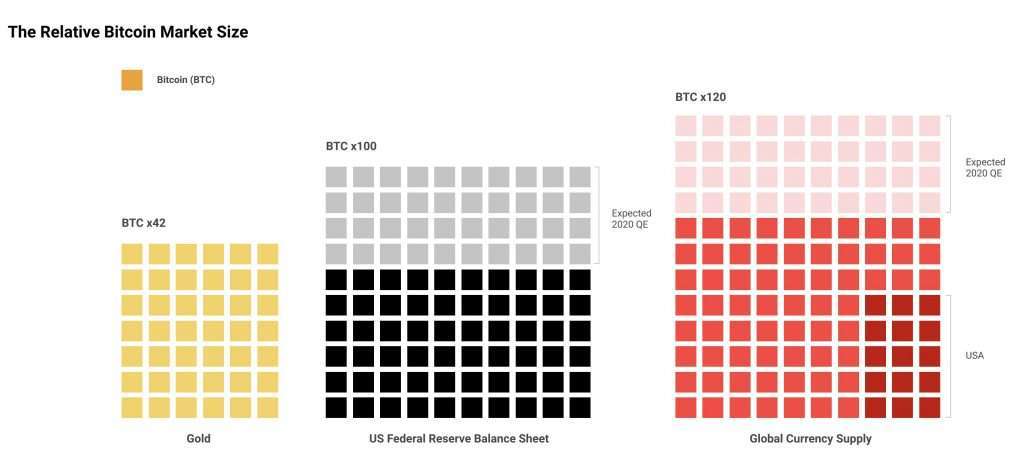

2016 – 2nd Halving

The second halving occurred on July 9th, 2016. The halving reduced the reward for miners from 25 bitcoins to 12.5 bitcoins.

before this Bitcoin Halving; there were 3,600 BTC released per day.

after this Bitcoin Halving; there were be 1,800 BTC released per day.

- New BTC Per Block Before: 25 BTC per block

- New BTC Per Block After: 12.5 BTC per block

- Price on Halving Day: $652

- Price at peak: $19,499

2020 – 3rd Halving

When block 630,000 is hit in May 2020, the subsidy drops to 6.25 bitcoins (BTC) per block.

before this Bitcoin Halving; there were 1,800 BTC released per day.

after this Bitcoin Halving; there were be 900 BTC released per day.

- New BTC Per Block Before: 12.5 BTC per block

- New BTC Per Block After: 6.25 BTC per block

- Price on Halving Day: ~$8,500

- Price at peak: $67,549

2024 – 4th Halving

The fourth halving is estimated to occur at 840,000 based on the block time of around 10 minutes on April 19th 2024. It’ll bring the block reward down to 3.125 BTC.

before this Bitcoin Halving; there were 900 BTC released per day.

after this Bitcoin Halving; there were be 450 BTC released per day.

- New BTC Per Block Before: 6.25 BTC per block

- New BTC Per Block After: 3.125 BTC per block

- Price on Halving Day: ~$??????

- Price at peak: $?????????

The Bitcoin Halvening: Key Numbers

This list is not exhaustive. Bitcoin halvings will occur every 210,000 blocks until around 2140, when all 21 million coins will have been mined.

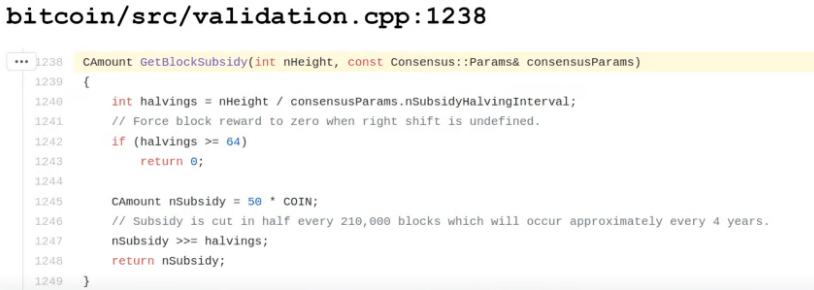

The Bitcoin Code that Enforces the Halving Event

Think of Bitcoin like a special treasure with a constantly shrinking reward:

The Treasure Chest

- Every time miners (treasure hunters) find a new “block” of treasure, they get paid in freshly created Bitcoin.

- Initially, the treasure chest held 50 Bitcoins as a reward.

The Shrinking Reward

- The treasure is hidden in batches of 210,000 blocks. After each batch is found, the treasure chest splits the reward in half.

- This “splitting” happens roughly every 4 years.

- The treasure chest has a secret rule: after splitting enough times, the reward becomes zero to keep the treasure truly limited.

The Code’s Job

The code you see above is like a rulebook for shrinking the reward:

- Checks Time: It counts how many blocks miners have found so far.

- Calculates Splits: It figures out how many times the reward should be split in half based on the number of blocks.

- Divides the Reward: It cuts the reward in half for each split that needs to happen.

- Gives New Reward: It announces the new, smaller reward for the next block of treasure.

Why Does This Matter?

This shrinking reward is how Bitcoin keeps its treasure rare and valuable.

By slowing down how new Bitcoins are created, the ones miners find become more precious over time.

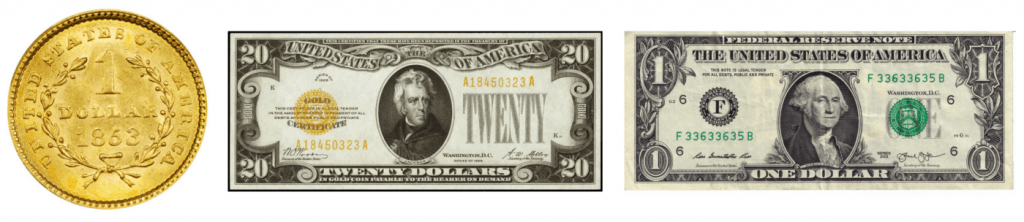

Bitcoin as a Store of Value

US Dollar experiences Phase transitions. For example the US Dollar has transitioned from gold coin (One dollar = 371.25 grains of pure silver = 24 grains of gold), to paper backed by gold (“In gold coin payable to the bearer on demand”), to paper backed by nothing (“This note is legal tender for all debts, public and private”). Although we keep calling it Dollar, the Dollar has totally different properties in these three phases.

» Think of it as Digital Scarcity Enforced by Energy

“[Bitcoin] is more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes. As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” – Satoshi Nakamoto

The true inflation rate (unadjusted cost of living) in major U.S. cities is closer to 10% than the nominal ~2% rate often quoted by government statistics bureaus. Source: The Chapwood Index pic.twitter.com/ggLgzOvKDw

— Gabor Gurbacs (@gaborgurbacs) April 26, 2020

To understand why money functions as a store of value first rather than just a medium of exchange, let’s understand human nature…

Your mind works in two different ways.

One works quickly and intuitively, but is often wrong half the time. (Higher Time-Preference)

The other is methodical and has a longer time horizon (Lower Time-Preference), but is lazy and loves to take shortcuts. It will only be undertaken with an expectation of a much better reward, or else it will hand things back to the ‘short term‘ system.

Short term thinking makes up the majority of people in the world. Watch the Stanford Marshmallow Experiment.

This higher time-preference originates from our hunter-gatherer days more than 100,000 years ago.

Instinctive and animalistic impulses allow us to survive better in conditions that are harsh especially in environments where predators exist.

Animals’ time preference is far higher than us humans’.

But every now and then, our animal instinct kicks-in as well.

It isn’t a bad thing. Our fight or flight response is built-in to keep us alive.

We all act to the satisfaction of our immediate needs such as hunger and aggression.

Two characteristics which we all still exhibit today.

But there’s always a trade-off.

The few who were able to defer their immediate needs and consumption had a bigger conception of the future.

We differentiated ourselves from animals by spending time developing tools for hunting.

We used our time, time that can be used to hunt more preys to develop and maintain ever more sophisticated tools for long-term use.

Building things that can last for the future requires a much lower time-preference.

It takes a shift in cognitive evolution for humans to one day decide to take time away from hunting and dedicate that time to building a fishing rod that cannot be eaten itself, but to allow us to hunt more proficiently.

Money is one of the tools we use as a store of value, to preserve our fruits of labor far into the future.

Imagine storing your wealth in apples, in hopes of exchanging it for a car.

- First, it is not easy to accumulate enough apples for that.

- Second, the apples would rot before the deal can be completed.

- Third, the apples are difficult to transport to another buyer in another location.

This system of barter and trading is highly inefficient and archaic.

Then over time humanity converged on a single standard of money. They call it the Gold Standard.

Unfortunately, gold was hefty. Easy to rob. Expensive to secure.

Gold became highly centralized in vaults controlled by central bankers. They devised a cunning plan to create monopoly in the market.

With that, FIAT money was born. It’s the money which we all use today as a by-product of this cunning plan. This kind of money is easily debasable, manipulated and controlled.

But this trend is about to change yet again.

Remember, these things ebb and flow. They rise and fall.

Money evolves. The natural evolution of money is always as a store of value that’s easier to move, more secure and more private.

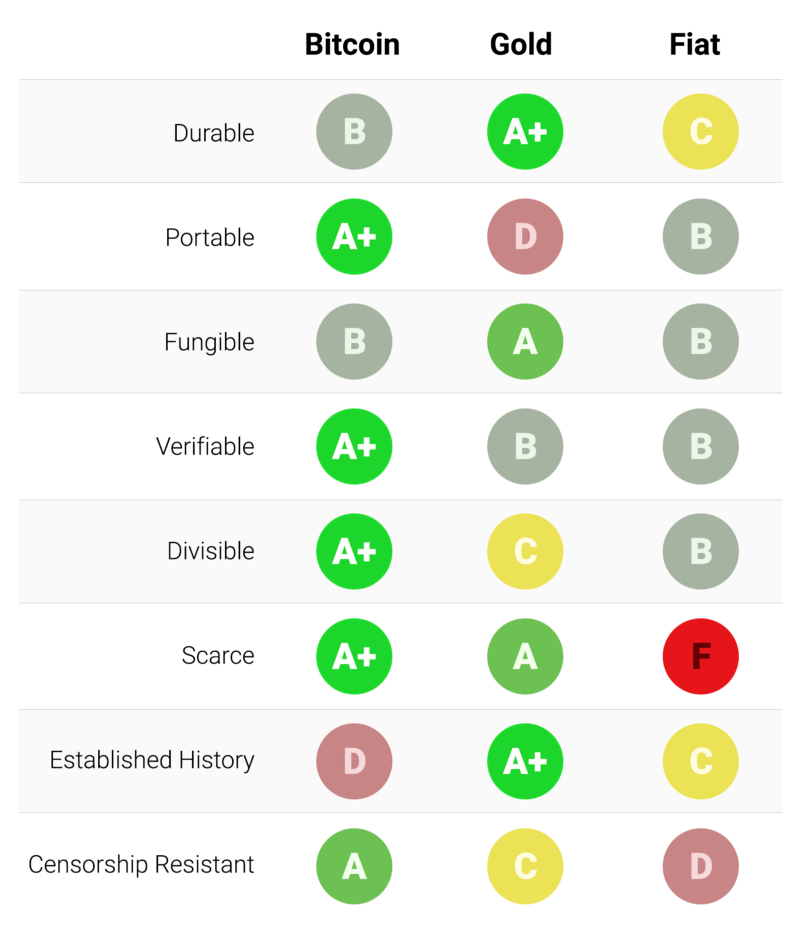

Over time, technology provided us with a far more efficient solution for money. Money that is:

- Scarce

- Portable

- Fungible

- Verifiable

- Divisible

- Durable

- Established history

- Censorship-resistant

Civilization started the moment we understood the superiority in playing the long term game.

That is the essence of sound money.

The world naturally gravitates to the next best thing.

Something that is neutral, censorship-resistant, open, borderless and decentralized.

Something that cannot be killed. Cannot be hacked. Cannot be banned.

Now imagine a base metal as scarce as gold but can be transported securely over the internet. That’s Bitcoin.

It may sound ridiculous at first, but it makes perfect sense. It’s counter-intuitive. Hard to understand. Easily misunderstood. But the opportunity for us to participate in this new gold rush is immense.

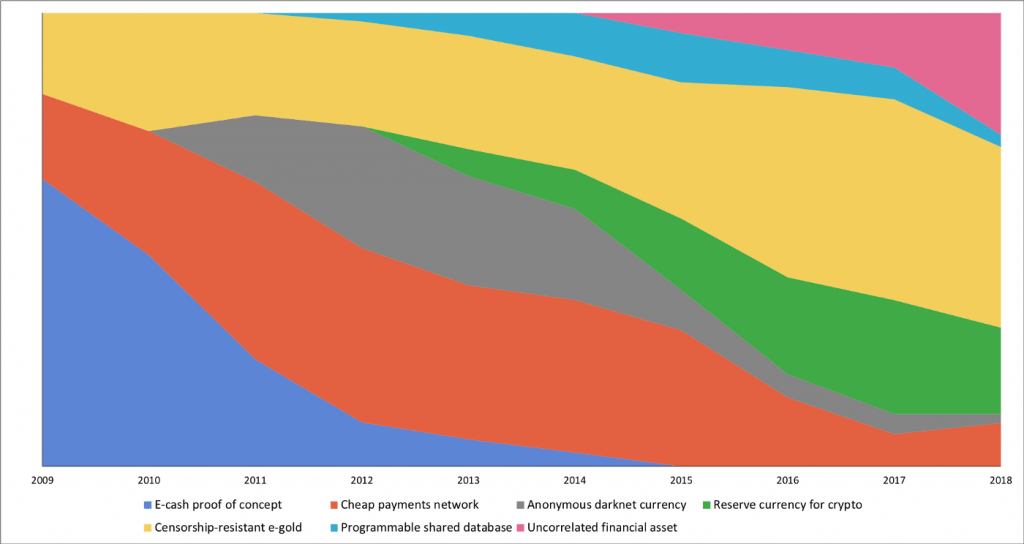

How major Bitcoin narratives changed over time

The Scarcity of Bitcoin

WOW!!https://t.co/v0OQGrulxu

— Dan Tapiero (@DTAPCAP) May 7, 2020

The rush to grab every last bitcoin before the halving is now underway. Calculating the cost of forging Bitcoin’s digital scarcity is perhaps the best way to quantify its value.

Why do investors like Paul Tudor Jones who’s currently worth $5.1B ever need to buy bitcoin?

He states: “I also made the case for owning Bitcoin, the quintessence of scarcity premium. It is literally the only large tradeable asset in the world that has a known fixed maximum supply.”

How about Marc Andreessen who’s worth $1.3B who sees Bitcoin as Human Evolution’s Next Steps.

Virgin Galactic Chairman, Chamath Palihapitaya who’s worth $1.1B sees Bitcoin as the best “Schmuck Insurance” for investors.

Or Jack Dorsey, the CEO of Block who’s worth billions, talking about Bitcoin becoming the world’s single currency. There are even Billionaires like Peter Thiel investing millions of dollars in building important Bitcoin infrastructure. Pay Attention. Don’t listen to what people say, watch what these people do.

» Satoshi Nakamoto: “As a thought experiment, imagine there was a base metal as scarce as gold but […] can be transported over a communications channel”

The number of whales (i.e. entities with at least 1000 BTC), suggests that extremely wealthy individuals are increasingly confident in parking a major portion of their assets into Bitcoin. In fact, they’re even accumulating them in a very big way.

Why? Because in a world where money is infinite debt, only scarcity can define true value.

It takes someone with the understanding of financial markets with an open mind for technology to be able to appreciate the kind of monetary technology Bitcoin brings to the table.

It’s incredibly disruptive.

Look at what Uber did to the taxi business, or how Airbnb is taking on the whole Hotel industry. Literally, no one from the old system ever saw it coming.

Saifedean Ammous who is one of the most vocal economist, wrote The Bitcoin Standard, in it he talks about scarcity in terms of stock-to-flow (SF) ratio. He explains that an untamperable monetary policy coupled with a consistently low rate of supply makes Bitcoin the most robust store of value ever conceived.

Nick Szabo, one of the two men mentioned by Satoshi Nakamoto, defines scarcity in terms of its ‘unforgeable costliness‘.

» Nick Szabo:

“What do antiques, time, and gold have in common? They are costly, due either to their original cost or the improbability of their history, and it is difficult to spoof this costliness. [..] There are some problems involved with implementing unforgeable costliness on a computer. If such problems can be overcome, we can achieve bit gold.” — Szabo

“Precious metals and collectibles have an unforgeable scarcity due to the costliness of their creation. This once provided money the value of which was largely independent of any trusted third party. [..][but] you can’t pay online with metal. Thus, it would be very nice if there were a protocol whereby unforgeably costly bits could be created online with minimal dependence on trusted third parties, and then securely stored, transferred, and assayed with similar minimal trust. Bit gold.” — Szabo

Bitcoin too has unforgeable costliness, because it costs a lot of electricity to produce new bitcoins. Each halvening forces the flow of bitcoins to be halved until 21 million bitcoins are fulfilled.

You can still fake gold, but you can never create or send fake bitcoins over the network.

It is truly the first scarce digital object the world has ever seen. Scarce like gold, but can be sent over the internet, radio or satellite.

Using SF, a quantitative analyst known only by his Twitter handle as PlanB calculated the SF value of Bitcoin and found a Cointegrated model that predicts the price of bitcoin with precision.

[Stock is the size of the existing stockpiles or reserves. Flow is the yearly production. Instead of SF, people also use supply growth rate (flow/stock). Note that SF = 1 / supply growth rate.]

Gold has the highest SF 60+, it takes 62 years of production to get the current gold stock. After the halving, Bitcoin’s SF is expected to reach just shy of gold’s SF.

- Pre-halving Bitcoin SF: 27

- Post-halving Bitcoin SF: 54

Logically, it would be foolish to spend your bitcoins today like the dollar when the price of bitcoin can still increase by a factor of 100x or more.

What you do for now is save in bitcoins and spend your dollars, pounds, euros, etc.

This has become known colloquially as “hodling.”

Why Are Halvings Important to SF?

Since the supply of bitcoin is fixed. New bitcoins gets created every 10 minutes (on average). It started at 50 bitcoins, and is halved every 210,000 blocks (about 4 years).

Halving events will take place until new bitcoin rewards for miners reaches 0 BTC. (Bitcoin’s value can represent down to 8 decimal places. e.g. 0.00015866 BTC)

After the 33rd halving, the reward will hit 0 BTC. (33 halvenings every 4 years adds up to 132 years in total)

The last Bitcoin to be mined into existence will be mined in the year 2140. It will be the 21 million’th Bitcoin to come into existence, and last, after which point it will be impossible to create anymore.

From then on, Bitcoin will become truly ‘deflationary‘, since “printing” / “minting” / “mining” new coins will no longer be possible.

That’s why ‘halvings’ are very important for bitcoins money supply and SF.

Each halving lowers Bitcoin’s inflation rate. The orange line is Bitcoin’s inflation rate during a given period, while the blue line is the total number of bitcoins issued. Bitcoin Inflation will drop to 1.74% on the third halving falling lower than current nominal ~2% inflation target often quoted by government statistics bureaus.

Halvings cause the supply growth rate (in bitcoin context usually called ‘monetary inflation’) to be stepped and not smooth.

When the bitcoin model price based on SF (grey) and actual bitcoin price over time is plotted, with the number of blocks as color overlay; this is what you get:

You can track the live updates of Stock-to-flow (SF) here https://digitalik.net/btc/

Each halving is represented by a dark blue dot turning into dark red. (Different colors are there to indicate how many days are left until next halving event.)

When SF comparison is made between gold and Bitcoin, it must be stated that any technological advancement in extracting more gold could result in higher than expected flows.

Bitcoin on the other hand uniquely benefits from mathematical certainty.

Is Bitcoin Designed to Rise Every Four Years?

People who suddenly dismissed Bitcoin for the last eleven years are suddenly worried. You see, no one is spending their bitcoin!

Each halving brings in new bitcoin buyers like clockwork.

Each halving creates a new wave of HODLers.

A higher Bitcoin price attracts media attention, increasing mining profitability which in turn adds more user adoption.

It’s a virtuous cycle of saving and collective prosperity that encourages a positive feedback loop.

Source @Pierre Rochard

Bitcoin is weird. How can the dollar-denominated price just keeps going…up?

And because the price keeps going up, HODLers are reluctant to spend. And if no one is spending bitcoin, how can it become a currency?

This is problematic. Nobel Prize-winning blogger Paul Krugman explains why:

» Paul Krugman: “What we want from a monetary system isn’t to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich. And that’s not at all what is happening in Bitcoin.”

Paul Krugman wants everyone to spend their money, because consumption creates wealth.

When Paul Krugman says that transactions make the economy rich, he means that consumer spending makes the government rich.

Take out a mortgage to own your dream home! Invest in your future with a six-figure student loan! Buy a car with 0 down! How about financing your dream vacation?

The more we consume, the more debt we incur. The rich become richer as a result. That’s how they steal the future of the middle class and poor. Indentured servants chained to invisible shackles.

There’s virtually no limit to household consumption – if we run out of money, lenders are happy to step in.

How then can we escape this vicious cycle?

By opting out.

Bitcoin is a tool for sending value all around the world, but it’s also an insurance policy against FIAT.

It’s an exit. An escape valve. A lifeboat.

And the thing about lifeboats is that you hope you don’t need them ever. But it’s important to have them nonetheless.

As a sovereign individual, understand that your power exists solely as a choice ready to be exercised by opting out of a corrupt, war-mongering, violent and chaotic regime.

How do you opt-out? You VOTE with your money.

You vote by exiting FIAT which enables the monopoly of violence for something neutral, censorship-resistant and fair which Bitcoin offers.

You vote by saving in a currency that enables you to protest against an authoritarian or a terrorist regime.

That’s powerful optionality.

People need options.

It changes the power dynamic between people and their government. Bitcoin plays this crucial role.

We’ve only just begun…

In the world of Bitcoin, there’s so much more to delve into. That’s why I created The Maverick briefing that tells the story of Bitcoin and the cryptocurrency revolution from every angle you can dream up.