Boasting a global clientele exceeding 30 million, eToro is a regulated stock broker with a cryptocurrency twist. In this guide, we demystify the process of how to by Bitcoin on eToro in 2024. Is eToro the ideal Bitcoin investment hub? We dissect fees, account minimums, security, and user-friendliness to help you decide.

Explore the streamlined steps to secure Bitcoin on eToro. Navigate the platforms nuances with our breakdown of fees, account requirements, security measures, and user interface.

Equip yourself with insights for an informed Bitcoin investment strategy. Dive into eToro’s features and make the most of cryptocurrency opportunities.

How to Buy Bitcoin on eToro Step-by-Step Guide

Embark on a detailed journey into the steps of acquiring Bitcoin on eToro this year.

Step 1: Initiate Your eToro Account

Open an eToro account by visiting their website and clicking ‘Sign Up.’ Fill in your email, choose a user name, set a password, and agree to eToro’s terms before hitting ‘Create Account.’ Provide additional details like your full name, residence, phone number, and tax identification number. A verification code will be sent to your phone for the final step.

Step 2: Navigate the Know-Your-Customer (KYC) Process

As a regulated platform, eToro adheres to KYC standards. Upload a government ID and a proof of address document displaying your name, address, and issue date. Quality and clarity are crucial for swift verification.

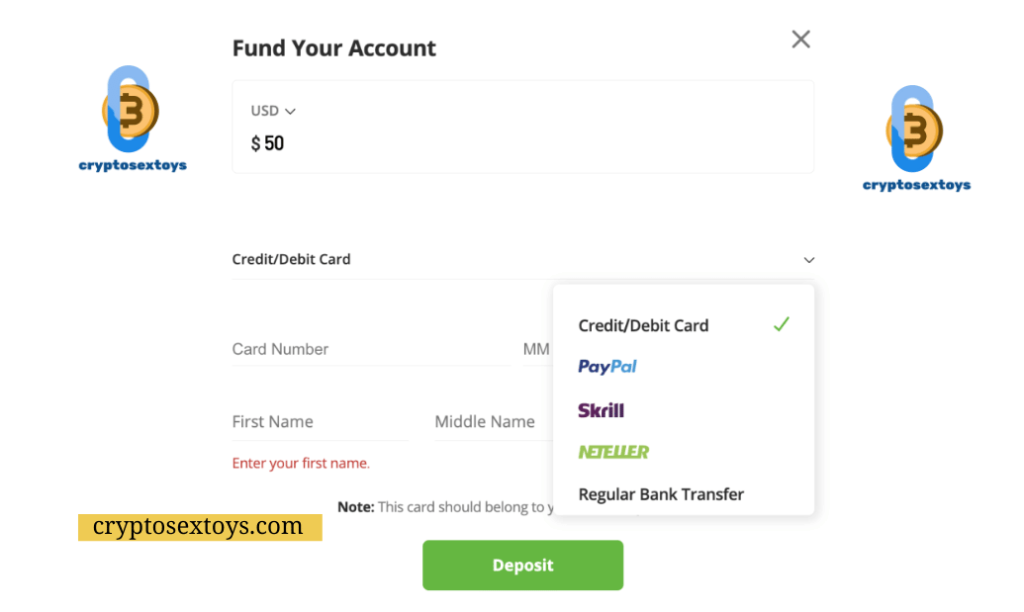

Step 3: Fund Your Account

Unlike some platforms, eToro requires a deposit before buying Bitcoin. Various payment methods are accepted, including credit/debit cards, e-wallets, and local banking methods. Select your currency, payment type, and amount (minimum deposit: $50).

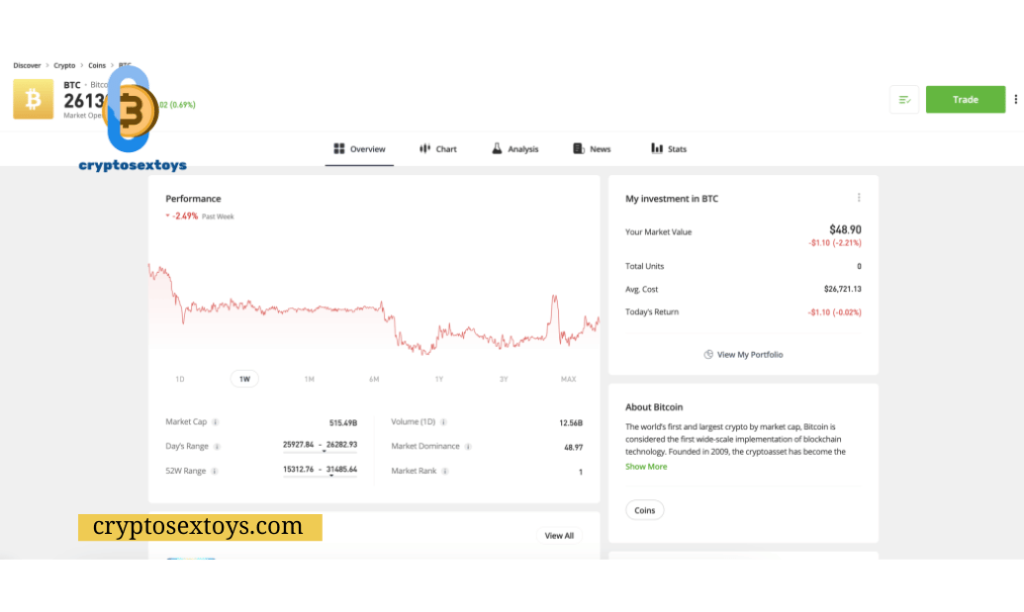

Step 4: Locate Bitcoin on eToro

Navigate to Bitcoin using the search bar among eToro’s myriad markets. Explore detailed research data or click ‘Trade’ to go directly to the Bitcoin trading page.

Step 5: Configure Your Order and Purchase Bitcoin

Choose between a ‘Market’ or ‘Limit’ order. ‘Market’ buys instantly at the current price, while ‘Limit’ allows you to set your purchase price. Specify your investment size or the number of Bitcoin units. Click ‘Set Order’ for a limit order or ‘Open Trade’ for a market order.

Step 6: Optional – Set Up the eToro Wallet App

While eToro offers custodial web storage, the wallet app adds flexibility. Download it from ‘Google Play’ or ‘App Store,’ sign in with your eToro credentials, and explore additional features like token swaps.

Bonus: Transferring Bitcoin to the eToro Wallet App For enhanced flexibility, transfer your Bitcoin to the eToro wallet app following simple steps via your eToro dashboard.

Seize control of your Bitcoin investment journey on eToro – click now to explore, trade, and optimize your cryptocurrency portfolio!

How to Sell Bitcoin on eToro Step-by-step-Guild

One standout feature of eToro is its seamless process for selling Bitcoin, available 24/7.

Step 1: Navigate to Your Portfolio Initiate the selling process by clicking on the ‘Portfolio’ button. Locate your Bitcoin position and proceed to the next step.

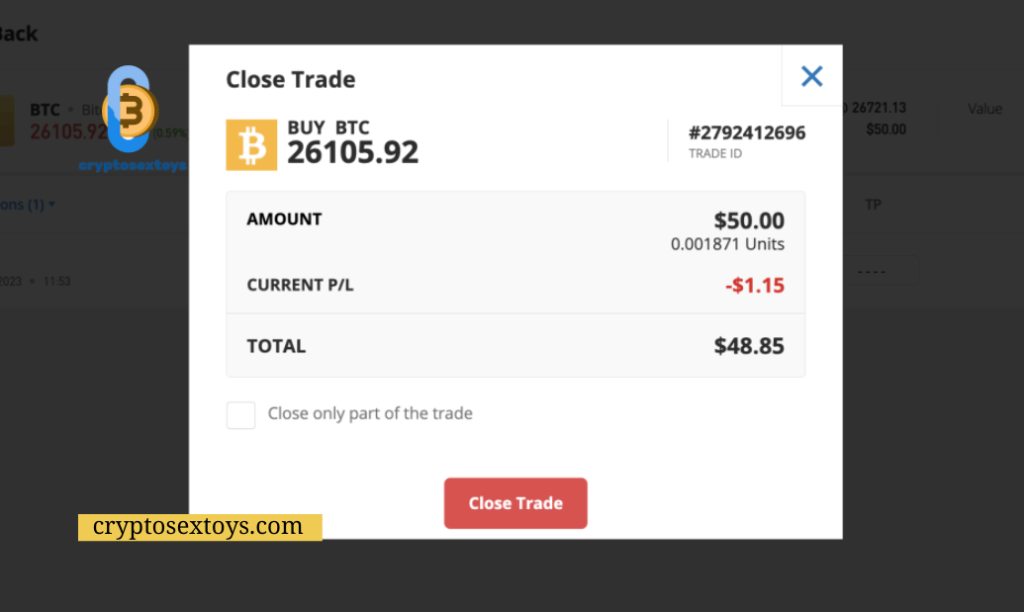

Step 2: Close Your Bitcoin Position Click on the Bitcoin position you wish to sell and hit the ‘Close’ button.

How to Execute a Bitcoin Sale on eToro Review your order details and confirm by clicking ‘Close Trade’. Watch as eToro swiftly executes the sale, instantly reflecting an increased cash balance. Now, you have the choice to withdraw your funds or reinvest.

Pro Tip: Tailor Your Sale to Your Needs You’re not obligated to sell all your Bitcoin at once. Opt for a partial sale by selecting the “Close Only Part of the Trade” option. Specify the amount of Bitcoin you want to sell, then click ‘Close Trade’.

Ready to seize control of your Bitcoin investments? Click here to explore eToro and effortlessly manage your cryptocurrency portfolio. Don’t miss out on the freedom to sell or reinvest at your convenience!

Why Choose eToro for Your Bitcoin Investment? The Pros and Cons

In the vast landscape of crypto exchanges, eToro shines as a prominent player. However, the decision to invest in Bitcoin via eToro requires careful consideration of its advantages and drawbacks.

eToro in Focus: A 2024 Review

eToro stands as a well-established trading platform with a robust user base of over 30 million clients since its inception in 2007. Holding tier-one licenses from major financial bodies, including FINRA in the US and FCA in the UK, eToro ensures a regulated and secure environment. Client-owned funds are meticulously safeguarded in segregated bank accounts, and additional protection is extended through the UK’s FSCS, covering collapses up to £85,000 per client.

Diverse Market Offerings

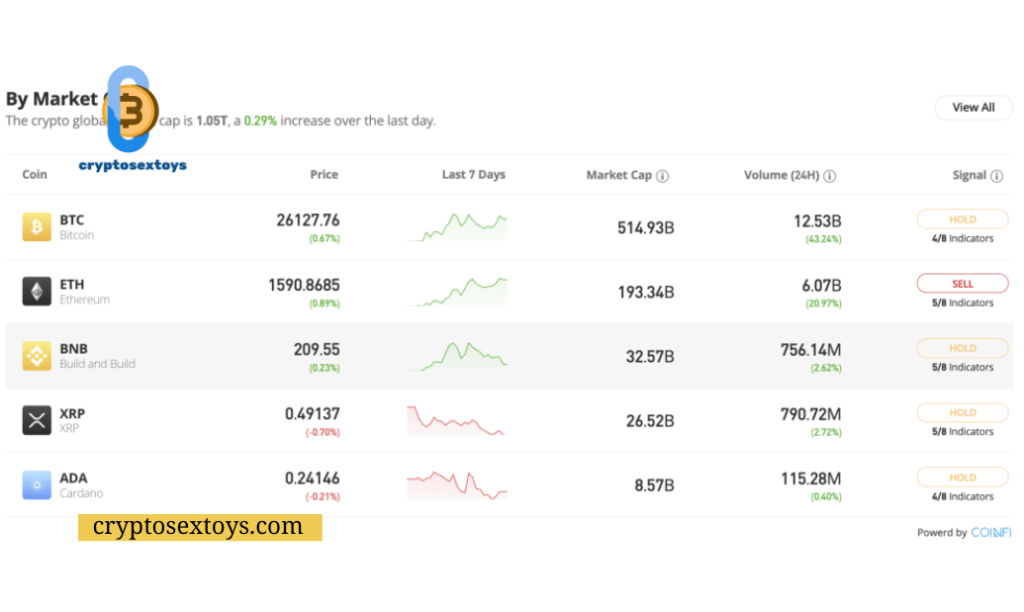

Beyond cryptocurrencies like Bitcoin, Ethereum, XRP, Cardano, and Solana, eToro supports over 3,000 stocks and ETFs across various global exchanges. The platform also ventures into CFD trading markets, including commodities, indices, and forex, albeit excluding clients in the US. While fees vary by asset class, eToro charges a 1% commission for cryptocurrency transactions, slightly higher than some competitors like Binance and OKX.

Navigating Fees and Payments

Despite relatively higher cryptocurrency trading commissions, eToro offsets this with competitive deposit fees. Depositing US dollars via debit/credit card or e-wallet incurs no fees, and even non-USD payments are subject to a reasonable 0.5% fee, notably lower than Coinbase and Gemini.

Technical Analysis and Tools

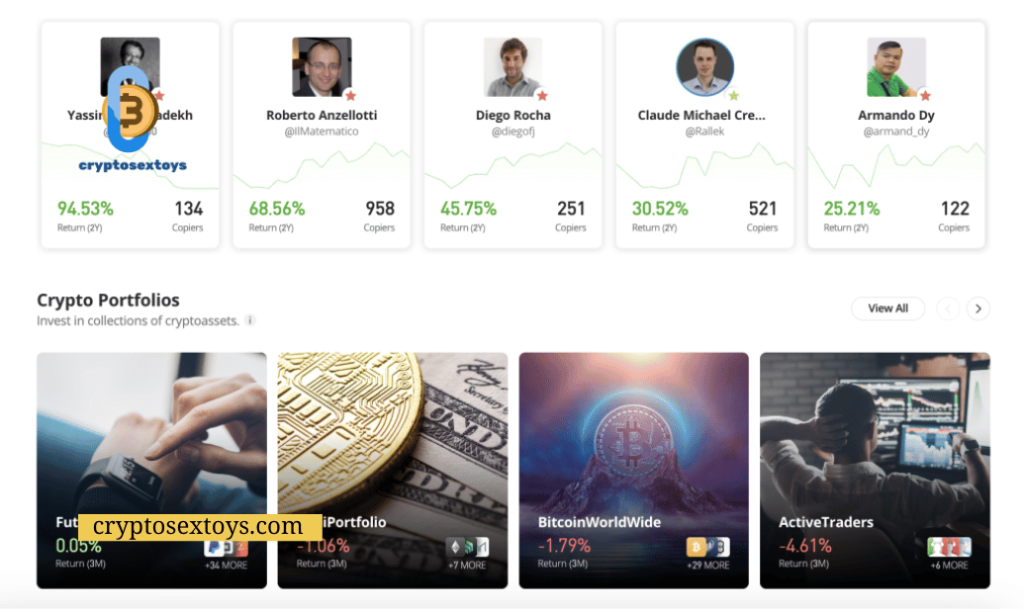

While eToro’s technical analysis tools are deemed basic, catering mainly to beginners, the platform compensates with features like sell-side analyst ratings, social sentiment bars, fundamental data, news feeds, and automated trading tools. Notable among these is ‘copy trading,’ enabling users to emulate the strategies of experienced investors.

Pros and Cons of eToro: A Detailed Overview

| Pros | Cons |

|---|---|

| Rated as ‘Excellent’ on TrustPilot with 21,000+ reviews | Experienced traders may find eToro too basic |

| Regulated by tier-one bodies including FCA, FINRA, ASIC, and CySEC | High cryptocurrency trading commissions at 1% |

| Buy Bitcoin and altcoins with a minimum investment of $10 | |

| Copy trading tool for automated investing | |

| Fee-free debit/credit card and e-wallet payments | |

| Robust research tools, including analyst ratings and news | |

| User-friendly dashboard catering to beginners |

How Much Does it Cost to Buy Bitcoin on eToro?

Unveiling the financial aspects of purchasing Bitcoin on eToro – a comprehensive breakdown of fees awaits you.

Deposit Fees:

Whether you encounter deposit fees on eToro depends on your payment currency. Depositing funds in US dollars incurs no fees, but if you’re using another currency, such as euros or yen, an FX conversion fee of 0.5% applies.

Comparison Note: eToro’s fees are notably competitive compared to Coinbase and Gemini, charging 3.99% and 3.49%, respectively, on debit/credit card payments.

Withdrawal Fees:

For US clients, eToro does not impose withdrawal fees. However, non-US clients are subject to a $5 withdrawal fee, regardless of the withdrawal amount or chosen payment method.

Minimum Withdrawal Amount: eToro enforces a minimum withdrawal amount of $30, ensuring a seamless cash-out process.

Trading Fees:

eToro maintains a transparent Bitcoin trading fee of 1%, applicable to all supported cryptocurrencies. This fee is incorporated into the spread, meaning it is charged on both buy and sell orders.

Comparison Note: While eToro’s 1% fee aligns with Webull’s structure, Binance and OKX charge a significantly lower 0.1% on Bitcoin trades.

Bitcoin Storage Fees:

Once you purchase Bitcoin on eToro, rest assured – there are no storage fees. The platform’s wallet storage service is entirely free of charge.

Bitcoin Transfer Fees:

While there is no obligation to transfer Bitcoin to the eToro wallet app, opting for this choice incurs a 2% fee, with a minimum and maximum fee set at $1 and $100, respectively.

Summary of eToro Fees:

| Fee Type | Fee |

|---|---|

| Deposits | USD deposits are free. Other currencies are charged 0.5%. |

| Withdrawals | USD withdrawals are free. Other currencies are charged $5. |

| Trading | 1% commission on buy and sell orders. |

| Bitcoin Storage | No fees. |

| Transfer to eToro Wallet App | 2% fee (Min/Max $1/$100). |

What Makes eToro a Good Place to Buy Bitcoin?

Discover the compelling reasons why eToro stands out as a top choice for Bitcoin investors, offering an unparalleled blend of accessibility, diversification, and cutting-edge automated trading tools.

1. Beginner-Friendly Interface:

Streamlined Account Opening: eToro’s user-friendly design caters to beginners, ensuring a seamless account opening process in under five minutes. All it takes is some basic personal information and a government-issued ID, aligning with anti-money laundering regulations.

Intuitive Buying and Selling: Navigating the platform mirrors the simplicity of online shopping. With a few clicks, you can deposit funds and express your interest in Bitcoin effortlessly. Buying and selling become straightforward tasks, empowering first-time investors to navigate the crypto landscape with confidence.

2. Diversification Opportunities:

Cryptocurrency Variety: eToro supports a myriad of digital assets beyond Bitcoin, including Dogecoin, Shiba Inu, Ethereum, Litecoin, Bitcoin Cash, XRP, BNB, Cardano, and more. This extensive range allows investors to diversify their crypto portfolios conveniently.

Beyond Cryptocurrencies: Extend your investment horizon with eToro’s support for over 3,000 stocks and ETFs from global markets in the US, Europe, Asia, and beyond. Additionally, delve into commodities, forex, and indices, understanding that leveraged CFDs govern these markets on eToro.

3. Automated Trading Tools for Passive Investors:

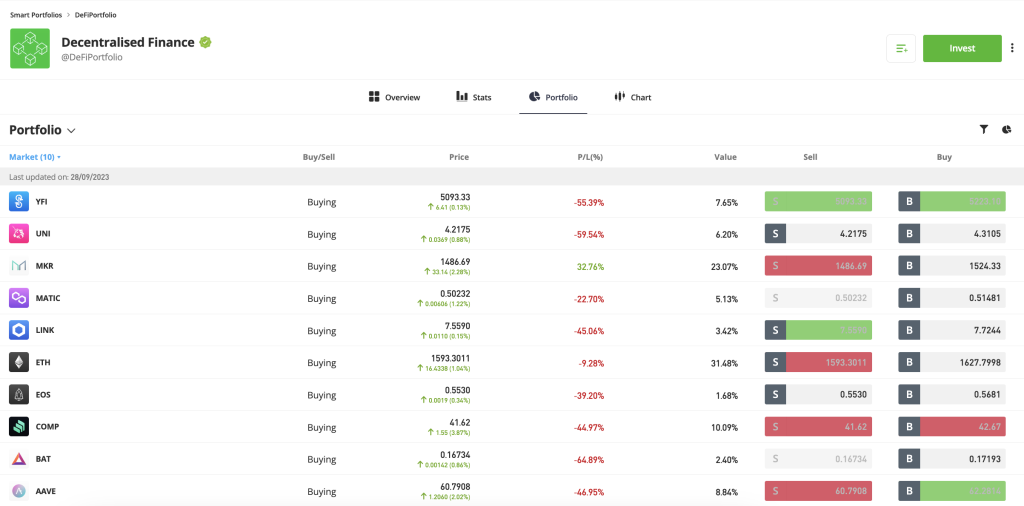

Smart Portfolios: For those seeking a hands-off approach, eToro’s smart portfolios offer professionally managed solutions dedicated to cryptocurrencies. With no additional fees, these portfolios require a minimum investment of $500, providing automated rebalancing for optimal performance.

Copy Trading Tools: Copy the success of seasoned investors effortlessly with eToro’s copy trading tools. Select an experienced investor, set your investment amount, and watch as your portfolio mirrors their trades proportionally. This passive investment strategy requires a minimum investment of $200.

4. Fractional Investing and Low Account Minimums:

Accessibility for All: While passive investment tools may require $200-$500, eToro ensures accessibility with low minimums for all other markets. Engage in fractional investing, allowing you to buy any supported cryptocurrency from just $10. This flexibility proves especially valuable for acquiring Bitcoin and Ethereum without significant upfront costs.

Minimal Deposit Requirements: To get started, eToro maintains a modest minimum deposit of $50, reduced to $10 for US and UK clients, facilitating a hassle-free entry into the world of crypto.

Security and Safety Measures

In the latter part of 2022, the cryptocurrency market witnessed a seismic event – the bankruptcy filing of FTX, one of the largest exchanges globally. This event served as a stark reminder to investors about the paramount importance of prioritizing safety when engaging in the crypto space. The lesson here is clear: opt for a Bitcoin exchange that adheres to stringent regulations.

Enter eToro, a platform that stands out for its robust regulatory framework. eToro operates under the oversight of four tier-one licensing bodies, providing investors with a sense of security that extends across different regions:

- FINRA (Financial Industry Regulatory Authority): Ensuring compliance in the United States.

- ASIC (Australian Securities and Investments Commission): Overseeing regulatory standards in Australia.

- CySEC (Cyprus Securities and Exchange Commission): Safeguarding the interests of investors in the European Union.

- FCA (Financial Conduct Authority): Serving as the regulatory authority in the United Kingdom.

These regulatory bodies play a pivotal role in holding eToro accountable. Notably, eToro is mandated to keep client funds securely in segregated bank accounts, preventing any utilization of investor funds, including digital assets, for operational expenses. This setup provides an additional layer of protection, assuring investors that even in the unlikely event of eToro facing financial challenges, their funds remain safeguarded.

Furthermore, eToro boasts institutional-grade security measures. The platform stores client-owned cryptocurrencies in cold storage, keeping them isolated from live servers and immune to hacking attempts. Two-factor authentication adds an extra layer of defense to user accounts. Opting for the eToro wallet app enhances security further, with the app being licensed by the GFSC (Gibraltar).

While it’s true that eToro imposes relatively higher trading commissions on cryptocurrencies, the peace of mind that comes with investing on a secure platform is invaluable. Prioritize the safety of your investments – choose eToro for a secure and regulated cryptocurrency trading experience.

eToro takes security very seriously and has implemented several measures to protect users’ funds. These include:

- Two-Factor Authentication: Users can enable two-factor authentication to add an extra layer of security to their accounts.

- Secure Socket Layer (SSL) Encryption: eToro uses SSL encryption to protect users’ personal and financial information.

- Regulated by Financial Authorities: eToro is regulated by financial authorities in several countries, providing users with a safe and secure platform to buy and sell bitcoin.

However, it is also essential for users to take precautions to secure their accounts. This includes using strong passwords and enabling two-factor authentication.

Tips and Recommendations

Here are some additional tips and recommendations for buying and selling bitcoin on eToro:

- Diversify Your Investments: It is always wise to diversify your investments and not put all your funds into one asset. This helps minimize risks and maximize potential profits.

- Stay Updated on Market News: Keep yourself informed about market trends and news related to bitcoin. This can help you make better investment decisions.

- Seek Professional Advice: If you are new to bitcoin or investing in general, it is always a good idea to seek professional advice before making any significant investments.

Conclusion

In conclusion, buying bitcoin on eToro is a straightforward process that can be done in a few simple steps. With its user-friendly interface and various funding options, eToro makes it easy for anyone to start investing in bitcoin. However, it is crucial to do your own research and understand the risks involved before making any investments. We hope this step-by-step guide has helped you understand how to buy bitcoin on eToro. Happy trading!